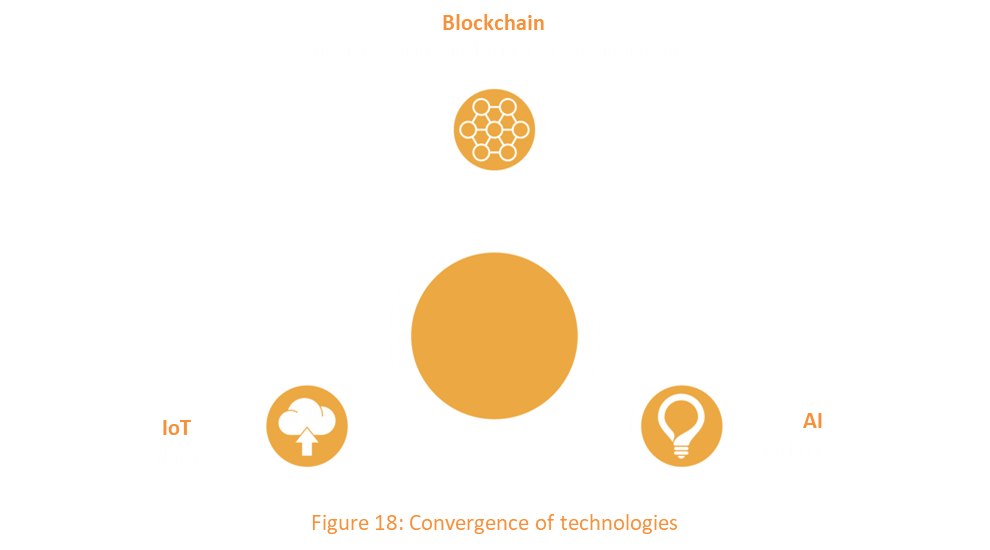

Today, blockchain technology, internet of things (IoT), and artificial intelligence (AI) are remarkable innovations, which will improve business processes, bring new business models into existence, and disrupt whole industries:

1

Blockchain, for example, can increase trust, transparency, security, and privacy of business processes by providing a shared, decentralized distributed ledger. Precisely, blockchain technology or, in general, distributed ledger technology can store all kinds of assets similar to a register.

2

IoT drives the automatization of industries and user-friendliness of business processes, which is essential for the German and the European industry.

3

AI improves processes by detecting patterns and optimizing the outcomes of these processes.

Currently, the interconnection between these innovations is mainly neglected. However, these innovations can and should be applied jointly and will converge in the future. A possible connection between these technologies could be that IoT collects and provides data, blockchain offers the infrastructure and sets up the rules of engagement while AI optimizes processes and rules. By design, blockchain, IoT and AI are complements and can exploit their full potential if applied combined.

In the following, you will learn about the added value, which blockchain, IoT and AI can provide for companies. The convergence of these technologies can be particularly beneficial for data management, identity management and the automatisation of business processes.

Standardization of data

IoT devices, such as sensors, machines, cars, or smart grids, collect a high amount of data. This data is often stored in a centralized database. Typically, these data lack standardization since different legacy systems for collecting and storing data are being used. Blockchain technology could support the standardization of data by setting up a harmonized digital platform for IoT data accessible for multiple parties. On blockchain systems, data is stored in one data format due to the use of hash functions. Therefore, data would be highly standardized. Moreover, the size of the stored data would be heavily reduced since hash functions transform the obtained data into a string of a specific length. Consequently, data management could be optimized by increased standardization of data.

Data privacy and security

In blockchain systems, the underlying cryptography enables a high degree of privacy. On most blockchains, e.g., the blockchain used for Bitcoin or Ethereum, transactions are conducted pseudonymous. However, it is also possible to enable completely anonymous transactions which is for example the case with Monero or Zcash. The architecture of blockchain systems i.e., private/public key infrastructure also allows full encryption of stored and transmitted data such that, if desired, only the device itself can read and write its own data.

The privacy of data is especially beneficial in the context of IoT. In IoT, machines, and devices store a high amount of sensitive data. It is essential to ensure privacy and security of stored data. It is common practice to send IoT data directly from the machine to the respective database for collection purposes.

However, there is a trade-off between a high level of privacy and control for illicit activities. In case transactions are anonymous, it is not possible to infer the name and the address of the transaction sender. This anonymity features illicit activities such as money laundering or terror financing. In this case, AI can be helpful and can increase security by detecting illicit activities. Certain research proposes to use AI, leveraging data analytics, to reduce the risk of illicit activities on the blockchain, which results from the anonymity of transactions. Note that AI technologies benefit from the high amount of provided IoT data as AI algorithms learn from data.

Scalability

A key limitation of IoT is the management of the massive amount of collected data. To improve scalability, the use of blockchain technology and AI can be highly beneficial. Opponents of blockchain technology argue that blockchain systems are per se not scalable because consensus mechanisms such as proof-of-work are very energy consuming. However, there are alternative consensus mechanisms such as proof-of-stake or proof-of-authority, which are more energy efficient and are scalable. Of course, consensus mechanisms will be and must be further improved. To reach a higher level of scalability on a blockchain, AI can be helpful. In academia, there is a suggestion for the use of a performance optimization framework for blockchain-enabled IoT systems. This system could be based on machine learning in the form of a DRL-based algorithm to dynamically select/adjust the block producers, consensus algorithm, block size, and block interval to improve the performance.

Authentication via a blockchain-based identity

Furthermore, blockchain technology can be applied for authentication purposes and is able to increase trust in network participants by managing the identity of IoT devices. In general, identity management typically refers to individuals and companies but can also refer to IoT devices and machines. Blockchain-based identities will make sure that transaction parties will receive a digital identity, which is based on their actual “real” physical identity: for

individuals’ identity cards and for companies it would be commercial register entry. Based on such identities, transactions between individuals and companies (e.g., car sharing) but also between individuals and machines (e.g., passenger transport of an autonomous car) or between two machines (e.g., autonomous car pays for parking) can be conducted and processed in an efficient way with low transaction costs and a high transaction speed.

IoT Analytics estimates that more than 20 billion devices will be connected to the internet by 2025. These devices will partly be connected to a payment network requiring a new payment infrastructure. Individuals, companies, and machines must be registered with their digital identities in order to participate in this new payment network. Blockchain technology is a perfect fit to provide a system for installing and managing digital identities in a secure and efficient manner. Therefore, identity management on the blockchain will be of major importance in the future. As with conventional centralized systems also the blockchain identity system has to comply with data protection laws. In fact, blockchain technology with its inherent access systems and encryption processes is even better than non-blockchain-based systems able to, first, protect data by design, second, organize the ownership of data and, third, facilitate the monetization of data. Blockchain also enables security of identity as the records are immutable and difficult to forge.

Automatization via smart contracts

Another field that highly benefits from applying blockchain, IoT and AI jointly is the automatization of business processes. Smart contracts have tremendous potential to yield efficiency gains in various sectors but are currently not heavily adopted in the industry. This is due to the fact that classical smart contracts require crypto assets. However, companies are typically reluctant to use crypto assets because of regulatory and economic limitations. The main drawback of crypto assets is their price fluctuations. If a smart contract is denominated in crypto assets, the receiving party is exposed to a high exchange rate risk due to the volatile price. Even if coins exert a high level of price stability (stablecoins), they might not be adopted by the majority of industrial companies due to several drawbacks: First, stablecoins are currently unregulated. Hence, risk-averse companies do not seek to use these assets. Second, the IT and accounting systems of companies are not denominated in crypto assets but in fiat currencies like the Euro or the US dollar. Converting stable coins into fiat currencies for accounting purposes is an operational burden as it costs both personnel and financial resources.

The blockchain euro

There is only one way how smart contracts can unfold their full potential. A blockchain-based fiat currency is necessary to “flow-through” the smart contract. Only a blockchain-based digital Euro would enable Euro-denominated smart contracts, such that IoT devices can directly offer services on their own like pay-per-use, leasing, and factoring. Due to a digital blockchain-based Euro such new business models could become reality: fully automated devices making decisions on their own while leveraging AI and “economically surviving” by using blockchain for financial transactions while implementing a profit center logic on the device-level.

With such a digital blockchain-based currency, micropayments for IoT devices could be conducted easily and cost-effectively. All transactions denominated in the blockchain-based currency would be directly included in internal accounting and IT systems and would not have to be converted. A further advantage would be that such a blockchain-based Euro would comply with current regulation. First startups like CashOnLedger and Monerium have developed such currencies in 2019. They use e-money licenses for the tokenization of fiat currencies. In contrast to crypto assets, and stablecoins in particular, companies demanding such payment solutions do not have to fear regulatory uncertainty since all players act under existing regulation.

Central bank digital currencies

As previously described, a blockchain-based Euro is currently issued by banks and e-money institutes. Also, the central bank could launch such a digital currency. In the literature, this is called “central bank digital currency” (CBDC). According to a recent study by the Bank for International Settlements more than 70 central banks worldwide analyze implications of CBDCs. However, only a hand full of central banks has introduced such a currency. Nevertheless, central banks are starting to engage with digital currencies e.g., the ECB announced the project “EUROchain”, which will be a CBDC prototype developed on the Corda DLT framework.

An ECB-issued blockchain-based CBDC would enable the use of central bank money for smart contracts.

Why is this necessary? What are the advantages of a digital Euro issued by a central bank compared to a digital Euro issued by e-money institutes? E-money counts as commercial bank money while money provided by the central bank is central bank money. Even if both kinds of money represent a digital version of the Euro, in the case of bankruptcy, commercial bank money could default, whereas central bank money is a claim to the central bank and cannot default. This difference gets highly relevant in case of financial turmoil when banks and e-money institutions potentially face bankruptcy.

Monetization of IoT devices via tokenization

Besides improving data management, supporting the authentication of network participants, and facilitating the automatization of business processes, blockchain technology can unlock new business models for the monetization of IoT devices. Blockchain technology enables the dematerialization of assets (“tokenization”).

An example: Think about a lamp (e.g., a streetlight), which has its own (blockchain-based) identity and operates with a blockchain-based Euro. The use of blockchain technology makes the lamp an autonomous entity, operating “on its own”. Via smart contracts, direct payments to the lamp are possible. If a respective payment is received the lamp will turn on. Such payments can be, provided by individuals, companies or even the public administration. As a consequence, pay-per-use payment schemes become feasible.

These lamps can further be tokenized so that investors can invest into them in the form of digital assets. Investors would have an incentive to build and maintain the lamps on a full scale as investors receive a share of the lamp’s profits. By providing incentives for investors to invest into building and maintaining the lamps, a new wave of investments could be generated. Tokenization is not only beneficial in the case of lamps but also for all kinds of IoT devices, such as sensors, cars, machines, or cameras. The only requirement for tokenization is a connection to the internet and to a blockchain network.

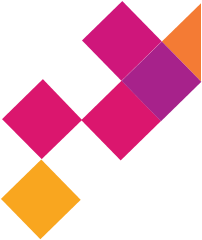

Figure 19: Examples of convergence of Blockchain, IoT and AI

Conclusion

Blockchain, IoT and AI are innovations providing tremendous benefits for security, transparency, immutability, privacy, and the automatization of business processes. However, the impact of these innovations is even higher when blockchain, IoT and AI are combined. We argue that these innovations will converge in the future, driving the digitization of the industry. This convergence will increase the quality of data management by reaching a higher degree of standardization, privacy, and security of data. Further, new business models are enabled such that autonomous agents (e.g., sensors, cars, machines, trucks, cameras, and other IoT devices) can be set up as profit centers that autonomously send and receive money.

We recommend executives to engage with these technologies in order to realize efficiency gains. Blockchain technology, combined with IoT and AI, will pave the way to a new age of digitization.

To dive deeper into success factors for the use of blockchain technology in all fields of business, listen to this Generation Blockchain podcast episode.

Climate change is one the most pressing issues of our times

Climate change is one of the most pressing issues of our times. Global warming has come to dominate the discussions in industrialized nations, and renewable energies and CO2 avoidance have come to the fore, as each report published by the Intergovernmental Panel on Climate Change (IPCC) demonstrates increasing urgency to act: ocean acidification, sea-level rise, and ecosystem extinction are at record levels. According to the International Energy Agency (IEA), carbon dioxide emissions have risen to their highest level ever, and according to NASA, 2022 is going to be the year with the hottest average temperature in the last 2000 years. The current trajectory is making the aim of the 2015 Paris Agreement to limit global warming to 1.5°C to avoid the worst impacts of climate change an increasingly ambitious target.

The carbon cycle, part of a complex system

Most carbon is stored in rocks such as limestone, with much of the rest being found in the ocean’s sediment, soil carbon, fossil carbon, plant biomass and atmosphere. As with everything else in nature, the carbon flow is a cycle: Carbon, mainly in the form of carbon dioxide and methane, cycles through the earth, the ocean, living organisms (plants, animals, micro-organisms), the atmosphere, through the land, the earth’s interior, and the ocean.

Man-made climate change and its impact results from the interruption of the natural carbon cycle. Specifically, carbon is released back into the cycle quicker than it can be absorbed by the natural system, mainly due to the combustion of fossil fuels.

This is happening as — despite urgent efforts — our modern lives are still mainly powered by fossil fuels that constitute around 84.3% (2019) of global primary energy consumption. This includes the industrial production of goods such as cement and steel, transportation, energy use in buildings, as feedstock for petrochemical products, etc. Other energy sources like renewables (such as wind and solar) and other non-fossil fuels (such as nuclear) represent 5.0% and 10.7% of global energy respectively.

At this stage it is clear to see that fueling our economy by burning huge amounts of fossil fuel is pushing the natural carbon cycle out of balance, as nearly ¾ of greenhouse gas emissions result from energy use, amplifying the greenhouse gas effect and resulting in a significant increase of global average temperatures.

The energy transition

The energy transition refers to a shift in the energy sector towards net-zero carbon. To achieve this, the energy system will need to move away from fossil fuels toward renewables. The predictions of the potential of renewables as a primary energy source vary between 70% International Energy Agency (IEA) and 75% International Renewable Energy Agency (IRENA) by 2050. A push of clean technology is needed (i.e., energy efficiency, circular economy

approaches, green transportation, alternative energy carriers like green hydrogen, etc.). Such a massive transformation in the global energy system implies major shifts, also in geopolitical power structures, as an energy system powered by renewables will differ profoundly from the energy current one.

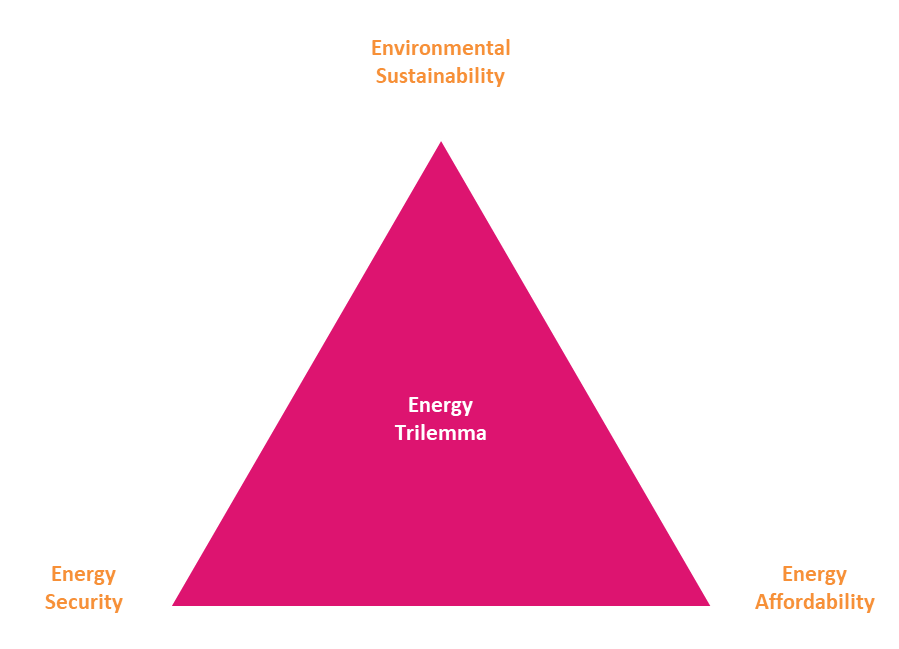

The trilemma

The war in the Ukraine made the vulnerability of the energy system and the challenge of balancing energy security, affordability, and environmental sustainability, also known as the energy trilemma, painfully apparent. Sustainability has the following facets:

Security

The ability to meet future demand and the resilience of the energy system to bounce back from interruptions.

Sustainability

The transition towards a “clean” energy system.

Affordability

The ability to keep energy universally affordable.

With Russia covering a high percentage of the global energy supply, energy security and affordability are greatly challenged, especially in Europe. For example, Germany is already preparing to ration gas during the coming winter. Furthermore, investments in big oil firms and an increase of coal-based power plants have been increased, challenging the sustainability component. While national energy strategies were greatly disrupted by the war in the Ukraine, there is a clear hope that the situation has created a sense of urgency to improve energy security through cleaner alternatives. That means, diversifying in terms of energy source and type, and a decoupling from Russia. The EU, for example, with its REPowerEU plan, has the target to accelerate the green transition to reduce Russian dependencies through, e.g., increasing hydrogen targets for industry and transport, as well as through increased investments.

The energy transition is complex and balancing the energy triangle will stay a challenging task, and energy strategies can be expected to continue being interrupted by unexpected events. Hence, the resilience for energy security and accessibility is critical for economic development and will be at the core of future strategies.

The financing question — mobilizing investments

One of the main questions in the energy transition remains who is financing this shift. Dynamically driving innovation requires the mobilization of a lot of capital. Not to forget that the rise of the fossil fuel industry was and still is highly subsidized by government spending. Governments still put several 100 billion USD into fossil fuels each year, whereas only a fraction of that is spent on renewables.

According to McKinsey, “USD 9.2 billion capital spending on physical assets for energy and land-use systems will need to rise by USD 3.5 trillion per year for the next 30 years and USD 1 trillion will need to be reallocated from high to low emissions assets.” (McKinsey, 2022)

To achieve the necessary mobilization of capital for the energy transition to occur it is necessary to focus not only on public funds, but to also tap into the trillions held by private actors. Thus, financial vehicles need to be created. Securitization that

split the high initial investment risks of those technologies’ developments while keeping capital sufficiently concentrated to push innovation,

sends demand-side signals,

supports additional finance streams at various risk levels, and

creates vehicles make real ESG efforts investable and create vehicles to re-pay for the green premium, may prove necessary.

Such financial instruments are not just crucial to further advance the energy transition in developed countries, but also to facilitate global development and push the transition in developing countries where financial markets are not as mature, and the cost of capital remains high.

The positive aspects a crypto-assets-based infrastructure could bring

In its 6th Assessment Report, the IPCC calculated a remaining carbon budget of around 400 Gt of CO2 that would still allow our world to comply with the 1.5 °C target. The current emission level is around 56 Gt CO2 per year and the average polluting country will run out of “emission budget” in around 8 to 9 years. This shows that a lot of capital will be necessary: Efficient capital allocation into green tech, ecosystem restoration and minimizing waste through circular economy approaches. These approaches, to just name a few, will be decisive for minimizing adverse climate change effects.

Markets that provide full transparency in terms of impact and accurate measurement along the value chain, that are scalable to many market participants, could use the proven mechanisms of our economic system and help drive the system towards a net-zero economy. But externalities and stakeholders need to be adequately represented and accounted for.

Smart contract platforms as trusted record-keeping tool for ESG criteria

Smart contract platforms such as Ethereum, in combination with other technologies like IoT, AI, and machine learning, establish a great basis for data recording in a trusted and transparent way. Through smart contracts, real-time data can be gathered along the entire value chain and automated, through programming business logic and regulatory insights into the ledger, pre-and post-trade. Standardized processes and integration with measurement systems streamline and optimize this, allowing for a high automation rate reducing time and resources needed.

Algorithms allow input data to be checked and verified instantaneously with the blockchain record serving as the ultimate truth in the long term. With this, verification and validation processes can be integrated using signing agreements, as well as proven and established methods from the ‘off-chain’ world to ensure data integrity. Once the right mechanisms for record-keeping are established, data can be stored and handled with minimal risk of error and across many individual parties, with reduced risk of manipulation. This could facilitate the transition from trust in traditional paper-based processes towards having real traceable data, along the entire value chain.

Tokenization and smart contracts as an efficient tool to incentivize and allocate capital for ESG efforts along the value chain

The standardization and rules for accounting units’ alignment process is an ongoing and highly complex topic. This also includes the effort to integrate those into a system with the right incentive structures. The result is a structure

that allocates capital for ‘true ESG’ efforts. The basis for such a system is data integrity and mutual benefit along the entire value chain. As discussed above, this has been highly challenging in the past decades. A DLT-based infrastructure can improve the situation, as data can be efficiently gathered in real-time pre- and post-trade, and mechanisms for verification can be integrated therein. In turn, this creates a highly trusted, and immutable audit trail. Token contracts provide a tool to create assets from data gathered along the entire value chain so that each participant in the system can monetize their actual ESG contribution without the need for intermediaries.

Future proof infrastructure for an evolving system

Smart contract platforms such as Ethereum have the unique capability to cater to the above-described requirements in terms of flexibility within a dynamic system, promoting innovation by enabling collaboration. Such infrastructure provides the possibility of integrating participants in an evolving market efficiently into the system on a trusted partner level. This allows data sovereignty and adaptation to locally differing and evolving requirements and standards. Through standardization and publicly accessible code, a high level of efficiency can be achieved.

Tokenization, an efficient tool to create financial instruments

As described above, data gathered along the value chain is documented in an immutable and trustworthy way on a distributed ledger. This highly trusted data can in turn be securitized in a standardized and highly efficient manner. It also allows programming business logic and applying regulatory insights in tandem with governance rules directly on the ledger, by use of smart contracts. This can support many of the needed mechanics, making this entire transition process scalable and improving what in today’s infrastructure is a time-consuming and cost-intensive process.

First benefit of tokenization: Split the high initial investment risks of those technologies’ developments, while keeping capital sufficiently concentrated to push innovation, and send demand side signals. Tokenization makes fractionalization of investments possible which may prove useful in the energy transition in many ways. One example of this would be a solar farm in the initial building phase. Investment and returns of those projects can be efficiently managed through smart contract platforms and their end-to-end integration — automated in combination with AIoT along the chain of custody.

Once the project enters the production phase, returns can be allocated according to initial agreements. This would also have a positive effect on capital aggregation and avoidance of too fragmented developments.

Efficient and automated processes pre- and post-trade generate massive gains in efficiencies and allow many investors to be included in a market that is otherwise accessible to institutional investors only due to its cost intensity. Hence, making more capital available while allowing retail investors a greater level of control over their portfolios.

While supporting the initial project development phase, financial instruments may be created at various stages of the project. At a later stage, once the technology is ready and the project is operational, a fractionalized investment could be used as a refinancing tool for developers leading to capital being available for new projects while facilitating the same mechanics along the way.

The second benefit of tokenization is the support of additional finance streams at various risk levels.

Conclusion

New possibilities around trust and transparency made possible through digitization and tokenization allows for new forms of decentralized documentation and securitization. This enables the realization of technological potential to transact and own assets in an unprecedentedly scalable manner, as many participants can be cost-efficiently integrated into the system.

This can open new worlds in terms of efficient capital allocation through transparent markets, enabled through: (1) an accurate and transparent lifecycle “track & trace”, (2) economic incentives to act sustainably for the many, and (3) a dynamic system that pushes innovation while allowing for collaboration in a trusted way within a growing system. This way, markets for all kinds of assets will be able to mobilize the vast amount of funds necessary for the energy transition at scale and speed.

The text stems from the academic article “Blockchain, IoT and AI – A perfect fit” published on March 25th, 2010 by Prof. Dr. Philipp Sandner, Dr. Jonas Gross and RicardaJoas. The authors consented to the use of the text for the purpose of the Generation Blockchain project.