The sharing economy is one of the fastest-growing segments in blockchain as well as in business. The sharing economy enables people to rent out their own property for use by others. Airbnb, for example, allows travelers to rent out part of an apartment or house instead of leaving it empty when on vacation. Uber and Lyft are a proxy for taxi cabs where the car of the owner is used to provide the service that normally a taxi would provide. The traditional sharing economy also has certain issues. There can be high fees for using the platform, bad working conditions and unfair revenue sharing that hurt individual users but benefit the underlying corporation.

Some companies have abused their power, for example, by receiving access to private data without customers’ consent. Sharing economy has also taken over in several blockchain related projects. One of the most promising use cases for blockchain in the sharing economy is the energy-sharing sector which the next section.

Blockchain technologies could be applied to a variety of use cases related to the operations and business processes of energy companies. Some of the potential applications and affected parts of business (models) are:

Billing

Blockchains, smart contracts and smart metering can execute automated billing for consumers and distributed generators. Utility companies might benefit from the potential for energy micro- payments, pay-as-you-go solutions, or payment platforms for pre-paid meters.

Sales & Marketing

Sales practices may change according to consumers' energy profile, individual preferences and environmental concerns. Blockchains, in combination with artificial intelligence (AI) techniques such as machine learning (ML), can identify consumer energy patterns and therefore enable tailored and value-added energy products provision.

Trading and markets

Blockchain-enabled distributed trading platforms might disrupt market operations such as wholesale market management commodity trading transactions and risk management. Blockchain systems are currently being developed also for green certificate trading.

Automation

Blockchains could improve control of decentralized energy systems and microgrids. Adoption of local energy marketplaces enabled by localized P2P energy trading or distributed platforms can significantly increase energy self-production and self-consumption, also known as behind the meter activities, which can potentially affect revenues and tariffs.

Smart grid applications

Blockchains can potentially be used for communication of smart devices, data transmission or storage. Intelligent devices in the smart grid include smart meters, advanced sensors, network monitoring equipment, control, and energy management systems, but also smart home energy controllers and building monitoring systems. In addition to providing secure data transfer, smart grid applications can further benefit from data standardization enabled by blockchain technology.

Grid management

Blockchains could assist in network management of decentralized networks, flexibility services or asset management. Blockchains could achieve integrated flexibility trading platforms and optimize flexible resources, which might otherwise lead to expensive network upgrades. As a result, blockchains might also affect revenues and tariffs for network use.

Security & identity management

Protection of transactions and security can benefit from cryptographic techniques. Blockchain could safeguard privacy, data confidentiality, and identity management.

Sharing of resources

Blockchains could offer charging solutions for sharing resources between multiple users, such as sharing EV charging infrastructure, data, or common centralized community storage.

Competition

Smart contracts could potentially simplify and speed up switching of energy suppliers. Enhanced mobility in the market could increase competition and potentially reduce energy tariffs.

Transparency

Immutable records and transparent processes can significantly improve auditing and regulatory compliance. Blockchains can enable and potentially disrupt established business models and traditional roles of energy utility companies.

Blockchain use cases can thus be distributed into the following eight larger groups according to their purpose and field of activity:

1

metering/billing and security

2

cryptocurrencies, tokens, and investment

3

decentralized energy trading

4

green certificates and carbon trading

5

grid management

6

IoT, smart devices, automation, and asset management

7

electric e-mobility

8

and general-purpose initiatives and consortia

The most popular category is decentralized energy trading (including wholesale, retail, and peer-to-peer) energy trading initiatives. The second most popular category is cryptocurrencies, tokens, and investment accounting. The third most popular use case is IoT, smart devices, automation and asset management, and metering, billing, security, and accounting.

Regulation of the blockchain energy sharing sector

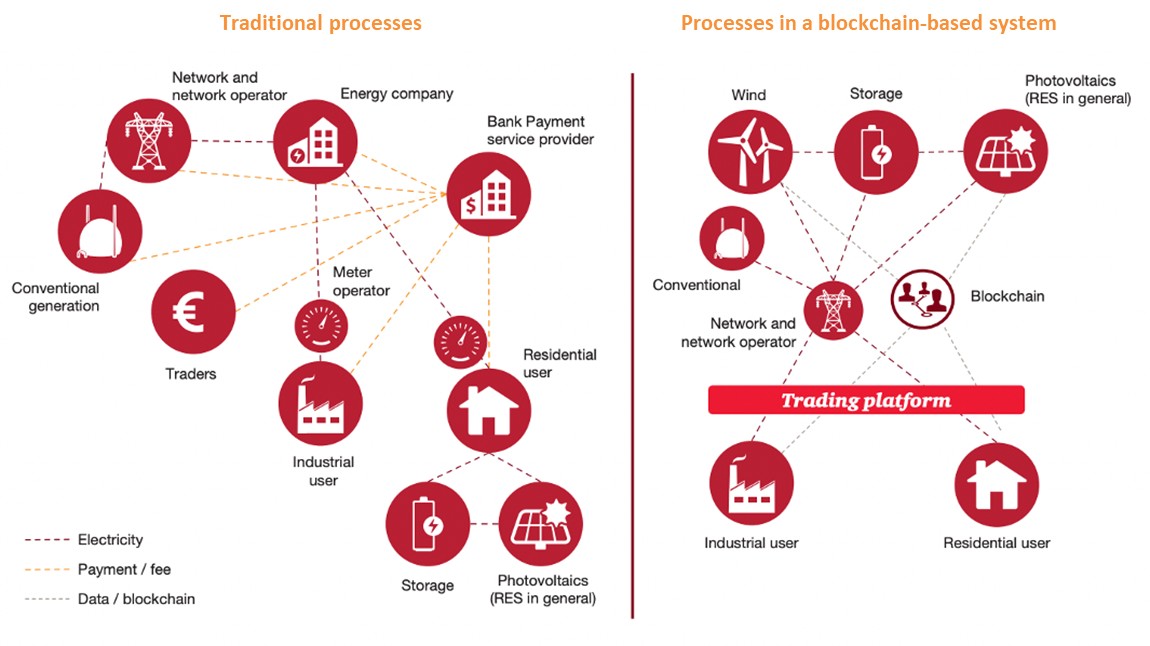

If a decentralized transaction model were to be implemented based on blockchain technology, it would cause a transformation of current market roles. These changes would also be reflected in regulation. All energy consumers would have to manage their own energy balances and meter operators would no longer need to collect data themselves since all transaction data would be recorded automatically on the blockchain.

As of present, the regulatory unbundling provisions require energy companies to separate their network activities (regulated business) from the supply of energy to customers (competitive activity). Customers have the right to freely choose their energy supplier (i.e., electricity or gas supplier) in a liberalized energy market. In order to ensure that customers can smoothly transfer between suppliers, so-called balancing groups were introduced. This made it possible for each customer to be assigned to a supplier in a simple way. Another significant area of regulation is the so-called clearing process, which is run to reconcile planned consumption against customers’ actual consumption as recorded by their meters. The difference between these is referred to as balancing energy and the costs incurred in relation to this are charged to each electricity supplier according to causation.

A key prerequisite for the regulatory regime to function is that each customer is accounted for as part of a balancing group. This is done by clearly assigning customers to balancing groups and their suppliers to the responsible balancing group managers (which may or may not be the same entity). The meter operators obtain readings of the verified meter data relevant for billing and transportation charging purposes and pass them on to the other players involved:

This shows that the delivery of electricity entails complex settlement processes across the entire electricity market and that the corresponding meter readings are required for various purposes.

Role transformations through blockchain

One major benefit of a blockchain-based transaction model is that all electricity delivered to the networks can be clearly attributed to individual customers in small time units (near real-time). Thus, electricity produced and consumed can be settled very precisely at variable prices. Interestingly, the physical electricity would continue to flow to the end user directly from the closest generator as is the case today. A simplified clearing process through blockchain would lead to less balancing energy being charged to market participants.

Figure 21: Figure 12: Transformation of market structures on introduction of decentralized transaction model (source: PwC study “Blockchain – An opportunity for energy producers and consumers?”)

As is shown, blockchain technology allows for direct contractual relationships between energy consumers and producers. Both energy consumers and energy producers could act as prosumers. This would result in the following changes:

Energy consumers

Energy consumers would have to become balancing group managers and to comply with the provision of security and risk management requirements of this market role. For example, energy consumers would have to submit their own demand forecasts to the relevant network operator.

The role of meter operators

Meter operators would no longer have to collect and record data themselves. The consumption and transaction data would be exchanged automatically and accurately. The transaction data necessary to determine network tariffs would be provided to meter operators (and thus also to network operators) by oracles. The responsibility of meter operators could be limited to providing reliable and tamperproof meters and oracles.

Distribution system operators

Distribution system operators would also receive the information on transactions they require to charge their network costs to customers from the blockchain.

Transmission system operators

If the decentralized transaction model is fully implemented, transmission system operators would no longer require receiving data for clearing purposes, as all transactions would be executed in real-time and settled only on the basis of actual consumption.

Financial market regulation

If financial transactions are no longer handled by energy companies or banks but by a peer-to-peer system, the responsibility for ensuring that financial transactions are properly settled also shifts.

While it would not be possible to impose such an obligation on the energy consumers this could cause unbearable administrative overhead work. Instead, an actual responsible entity, e.g., a platform operator, would be needed that would meet the requirements to be satisfied by a financial service provider of the respective

legislation.

Looking at the regulatory transformation of blockchain technology in the energy sector shows that blockchain business models and the overhaul of existing customer and provider relationships in the context of law are far more complex than one might think. The idealistic blockchain model without a responsible central authority is not a feasible option, as this would require clear and transparent liability rules and compliance with local regulations to ensure that such a platform can be operated properly and securely. Without such, the liability of the parties involved in the case of payment defaults, technical failures or intentional tampering would not be covered. As the energy supply business involves the use of critical infrastructure, the event of a complete or partial failure of the system must be prevented by emergency plans.

Opportunities for blockchain technology in the energy sector

Blockchain technology could lower energy bills for consumers since these systems operate on the assumption that all providers transact directly with their customers. One consequence of this would be that the intermediaries previously operating in the market, among them trading platforms, traders, banks, or energy companies, might no longer be needed or that their number and importance would be reduced. This could lead to a significant decrease in system costs. The reduced or eliminated types of system costs include the following:

The above cost reductions would lower the energy bills of consumers, whether directly or indirectly. There are operating costs of blockchain systems, which include transaction fees for blockchain transactions. Here, the required computing power and related energy use also belong to the operating costs. As of today, the actual costs of blockchain applications cannot be projected.

Set up of a blockchain as an operation cost factor

What is definitive is that private blockchains usually involve lower transaction costs and usually operate on the basis of simplified verification processes leading to lowered costs. These cost considerations must also factor in the investment required to make the electricity networks flexible. Blockchains can only be used effectively if the power grid can cope with a larger number of individual energy producers and of managing greater flexibility, all of which is also essential to ensure supply security.

Network effects

Another point to be considered is that maximum cost benefits can only be achieved via network effects in which as many providers and customers as possible agree to use blockchain applications that are based on common standards and rules. This would prevent the parallel emergence of incompatible applications and the need for bridges between different systems.

Energy consumer benefits

Additionally, energy consumers would also have greater flexibility in choosing their supplier. In blockchain-based transaction systems customers almost constantly switch supplier, as they can find new transaction partners and contract with them within extremely short timeframes

Transparency

The use of blockchain technology would ensure greater transparency for consumers, for example in tracking exactly where the electricity they purchase was produced. Direct transactions between energy providers and energy consumers would allow the parties to define the “contractual counterparty” (i.e., the wind or solar farm delivering the energy). The source of the electricity supplied could be tracked exactly as well as the exact percentage share of renewable energy. Each energy consumer could specify these aspects individually and to an unprecedented level of granularity.

The transaction history stored on the blockchain (energy consumed and payments made) would also become transparent. The availability of a full transaction history and the possibility of conducting analyses on this basis would bring customers a yet unrivalled level of clarity. The monetization of such data which is owned by and at the disposal of commercial and large customers would be inhibited but at the same time probably reveal more details on which they could base their analyses. This level of transparency would clearly also cause new difficulties, as all transactions are publicly accessible. Though pseudonymous aliases can be used, it is theoretically possible to “decrypt” a certain number of aliases without authorization.

Local value creation and prosumers

Blockchain technology could also boost to a current trend: the rise of the role of the prosumer that we have already looked into when talking about web 3.0. In the context of energy sharing, lower transaction costs and simplified billing processes could enable small providers or energy consumers to participate in the market not only as consumers but rather as providers. If consumers operate their own solar systems, they could more easily sell the produced electricity to their neighbors or feed it into the network. This would lead to improved viability of solar systems, small-scale wind turbines or customer-owned CHP plants. This in turn would increase the number of prosumers again. In the energy sharing economy, consumers also benefit from a more diverse product offering and lower prices.

In addition, blockchain models could facilitate the realization of community-funded energy projects. Simplified routes to market for distributed energy generators would further boost the growth of renewables. Indirectly this might also have a positive effect on the economic structures in the region of production. Distributed generation can provide economic stimulus through services, for example in the fields of maintenance or operations. Increased deployment of wind power could be a particular benefit in areas with little infrastructure and slow economic growth.

Risks in the energy sector

Blockchain risks in the energy sector blockchain technology are still largely unexplored, which means that it comes with a range of uncertainties and risks since there is no long-term

long-term experience available. Many experts also suspect that blockchain technology might not be as scalable as needed for certain uses. Given the extremely fast rate of data growth, the sheer data volumes accumulating after several years of operating a blockchain place high demands in terms of security, speed, and costs. As a new technology operating on the basis of a completely new transaction model, it is to be expected that blockchain technology will at least to some extent be rejected by some energy players, among energy consumers, and in part by the general public. Blockchain technology is a rather clunky database system that requires many copies of the same data to be stored, communicated, and added to at all times. The anonymity underlying the blockchain concept also entails the risk of the system being used for the purpose of illegal activities (e.g., organized crime). A decentralized blockchain system without any superior authority might also turn out to entail drawbacks for consumers, as at least under the models discussed today there is no responsible entity that could intervene in a regulatory capacity, provide simple services, or revise previously executed transactions. What would happen when a user forgot their personal access details needed to access their own account? In this case, users are irrevocably locked out of their accounts and lose their settings, information and assets stored in them.

Security risks

Non-cryptocurrency use cases of blockchain technology are more complex and require the direct participation of end users. They must be secure but user-friendly at the same time. Still, there will always be a risk of tampering (e.g., attacks by hackers) and technical faults (e.g., system failures). Just how realistic the hacking scenario is was proven by the attack on the application “DAO” (Decentralized Autonomous Organization).

Common problems specific to blockchain in the energy-sharing economy

A technical challenge of P2P electricity trading systems from a grid's management perspective is that every node needs to respond to grid conditions, prices, local supply, and demand. This could result in the need for individual consumers to provide demand forecasts for use by the system operator, similar to current electricity market operations.

Machine learning techniques can be used to predict future behavior of large sets of prosumers and electricity consumers, but it is argued that the aggregation of multiple blockchain users to comply with grid reliability requirements forms a technical challenge, as it might increase uncertainty and costs of balancing services.

Here, the deployment of distributed storage systems and the adoption of electric vehicles could help to overcome these challenges. Another looming consequence is that if energy systems evolve to being more local and decentralized, the traditional roles in the energy system (i.e., energy retailers or grid operators) could be disrupted. Increasing energy self-sufficiency could bring reduced revenues, while at the same time costs related to the operation and maintenance of the power grid could increase, as grid asset utilization deteriorates.

While blockchain technology can contribute to meet ESG goals and turn economies greener, Bitcoin certainly poses a threat to sustainability efforts. To learn more about Bitcoin’s energy consumption, watch this Generation Blockchain video.

Click here to watch the Generation Blockchain video on Bitcoin Energy Consumption.