Stock market trading itself has already undergone a disruptive change in the recent past. Electronic trading, clearance and settlement systems have against what was believed previously not really eliminated jobs on the trading floor. Rather, only some regional exchanges have become unprofitable and insignificant, and with them and, as a result, a number of professions. This innovation has led to an enormous increase in efficiency in stock exchange trading. As a result, trading volumes and turnover have increased, transaction costs have decreased, and new exchange products and jobs have been created. The significance of the world's leading stock exchanges has increased the technological revolution. For this reason, further efficiency gains for example through blockchain technology in secondary trading and settlement are likely to be unpromising. Other areas of application for blockchain technology promise greater innovation potential and thus higher profits.

Issuing securities

The issuing process of securities on the primary market for example is currently still costly and complex. Blockchain technology could generate effects similar to those of electronic trading for the secondary market. The Bank of the State Baden Württemberg (LBBW) in Germany and Daimler AG have issued a prototypical bond with blockchain technology as pioneers. This indicates that the efforts to develop applications with added value are being intensified not only among FinTechs as is often believed. One application that has already widespread application are so-called initial coin offerings (ICO). The similarity in name to an initial public offering (IPO) is not coincidental with the issuance of shares on the primary market. An IPO in the analog market is lengthy and costly since many disclosure requirements and stock exchange regulations must be complied with. It, therefore, made sense to use the instrument outside of regulation in the digital world to raise capital. As an example, one can now delineate from the ICO's how the incorporation (or subjection) of these issues into financial regulation is taking place. If necessary, the authorities are also prepared legally to enforce equal treatment.

Electronic payment & business processing

Another area of application for blockchain technology is electronic payment and business processing. This involves both, the more efficient of conventional payment transactions as well as the replacement of business processing. The advantages of blockchain technology should be the speed, security, and trustworthiness of processing. In leading industrialized countries, especially the European Union it should be difficult to compete here with the European System of Central Banks (ESCB) in international payments. In contrast, blockchain may find high acceptance in economic regions with trust deficits, security gaps, and/or inefficient payment processing. However, this advantage will only come to fruition if there are numerous interfaces and bridges to the real world exist. This requires the affordability of goods and services of all kinds with cryptocurrency. It is rather unlikely that this will be the case in, of all places, countries or regions where traditional payment systems and other innovations are not yet established. The Bundesbank and the ECB, in monitoring blockchain developments and the digital currency markets have so far concluded that the processes and costs of their systems are significantly more efficient and cost-effective. Nevertheless, both institutions are also testing blockchain technology in order not to miss out on new developments, if necessary. Another potential savings from blockchain technology, which could result from the lack of regulatory and financial oversight costs for this type of payment processing, is only true as long as the number of payment flows is not systemically relevant.

Payments Across Borders

Multinational banks such as UBS and British Barclays use blockchain to streamline back-office operations and settlement, which could potentially decrease US$20B expenses for third-parties involvement. For example, in 2019 Barclays invested US$5.5 million in startup called Crowdz that helps businesses to promote B2B cash turnover. As a result, it offers alternative ways of payment collection and automation of e-invoices. Another renowned Spanish bank has cooperated with the DLT-based company to add visibility to their international payments and dramatically accelerate them.

Pressured adoption of blockchain technology

If, on the other hand, they have reached a significant scale and would be used across the board to pay for goods and services, these services would not be concealed from financial supervision. At the latest, regulation would then be created. Blockchain activities in the financial system that remain outside of regulation would then, at best, have the meaning of a black market and would then, if necessary, also be relevant under criminal law.

New business models

The potentially most promising application of distributed transaction registers is to be seen in the linking of banking transactions and real economic business processes. Broader use of pay-per-use processes, real-time settlement of transactions in value chains and cash-flow-oriented corporate financing with smart finance can be expected. These represent new services whose forms of financing will be digital and automatized. Their settlement does not necessarily require an artificial currency. On the contrary, virtual currencies will be able to conquer this market as a payment medium only if transparency increases, fraud disappears, and value stability is established and controlled. In any case, this will further revolutionize the financial services business. In addition to FinTechs, which are often the focus of attention, and which are using innovative solutions to drive the competitors with innovative solutions, established financial service providers are also experimenting with digital process solutions. They have the advantage here, of the functionality, security, and costs of the existing systems and processes and can leverage this expertise.

Cost reduction

One motivation for the development of distributed ledger applications in the Finance arises from the high costs of banking and financial regulation. Avoidance of these costs in the provision of financial services can bring significant competitive advantages. Due to the inefficiency of many regulations, most digital market players are unlikely to view the elimination of supervision as a loss of security or stability. An elimination of regulation in digital business processes is therefore unlikely to be detrimental to business. The potential applications of blockchain or distributed ledgers in the financial industry are extensive and vary in their level of development. The tendency their use is worthwhile if the security, speed, and efficiency of financial services can still be improved. Transaction costs can be reduced on a large scale, and the innovative service providers can generate high returns from the resulting efficiency gains. The prerequisites for such a triumphant advance of distributed, digital register transactions are in place in the application areas: Securities issuance (primary market), securities trading (secondary market), payment transactions, financing of pay-per-use, and digital payment. While in the areas of secondary trading and payment transactions,

the challenges of finding a technical solution and at the same time the efficiency improvements of the last few years through innovative solutions are already considerable, there is still great potential for the new technology in the primary market and in financing technology. In addition, completely new fields of application for blockchain will emerge with the shared economy as well as the usage-based transfer and payment of assets. In the business areas that are already digitally advanced, blockchain and distributed transaction registers will represent additional options to further develop existing further develop existing systems and processes. In other areas, where time and costs are currently still high, the new technologies will trigger radical changes. Especially in the issuance market for securities has seen considerable movement with ICOs. The regulation of ICOs that is currently regulation of ICOs demonstrates the systemic relevance already achieved. Regulatory equal treatment will not reduce the importance of the financial instrument. On the contrary, it can be assumed, especially after legal clarification, that the underlying technology will significantly simplify and modernize the analog issuance process. For new applications, blockchain technologies will be used exclusively from the outset.

With regards to the players in the financial markets of the future, it can be summarized that established competitors, who are at the forefront of development, will continue to play an important role in the future due to their market and customer will continue to play an important role in the future. Of the many FinTechs many companies will not reach the profitability threshold and will disappear or be acquired by other competitors. However, some of the start-ups in the financial industry will certainly rise to become large, profitable market players. A more precise forecast of which providers these are, cannot be given at present. The state and its supervisory institutions have so far been able to follow the innovations from an observer's perspective.

To dive into a specific financial use case of blockchain technology, watch this Generation Blockchain video on the digital euro and digital dollar and how they work.

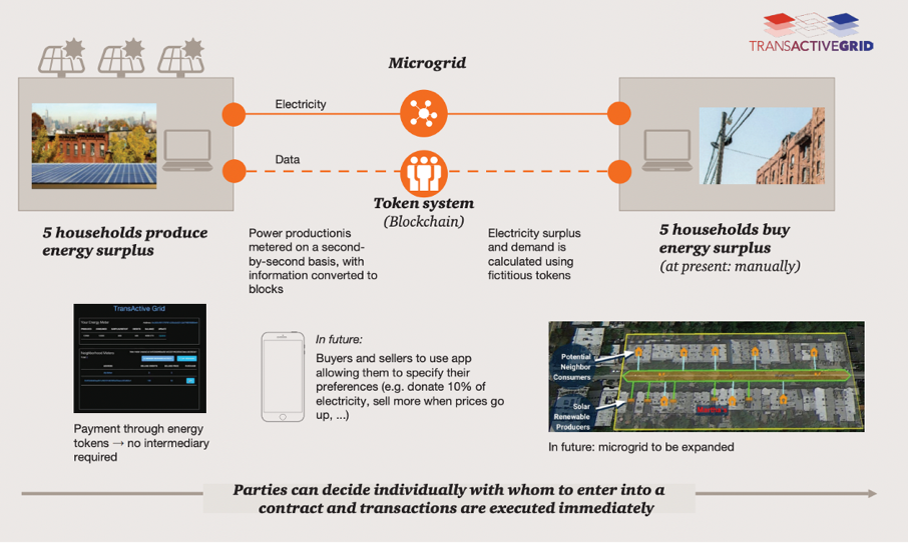

The Brooklyn Microgrid is a blockchain-based P2P energy trading platform that is run by Transactive Grid. Transactive Grid is a partnership between LO3 Energy, Consensys, Siemens and Centrica. This microgrid is located in the Gowanus and Park Slope communities in Brooklyn, New York. It has successfully completed a three-month trial run of P2P energy trading between community members in Brooklyn.

With Microgrid, prosumers can sell their energy surplus directly to their neighbors. This is achieved by the use of Ethereum-based smart contracts and the so-called practical Byzantine Fault Tolerance (PBFT) consensus mechanism. The first trial included 5 prosumers and 5 neighboring consumers and resulted in the first-ever energy transaction recorded in blockchains worldwide. The energy surplus is measured by smart meters that can conduct physical energy measurements and record data, and sequentially transformed in equivalent energy tokens that can be traded in the local marketplace. Tokens indicate that a certain

amount of energy was produced from the solar panels and can be transferred from a prosumer's smart meter wallet to end-consumers via blockchain. Tokens are burned by the consumer's smart metering device, as purchased energy is used in the house. Microgrid users interact with the platform by specifying their individual price preferences in the form of willingness to pay or sell electricity. The platform can display location-specific and real-time energy prices. In the initial phase of the project, users manually trigger an agreement in the platform, whose terms are recorded in the blockchain. The ledger records contract terms, transacting parties, volumes of energy injected and consumed as measured by metering devices and crucially the chronological order of transactions. In addition, payments are automatically initiated by self-executed contracts. Every member of the community can have access to all historic transactions in the ledger and verify transactions for themselves.

Figure 8: BrookylnGrid project (Source: Microgrid, 2022)

During the trial phase, more than 300 houses and small businesses, including around 50 prosumers and one small wind turbine generator, have signed for the next phase of development, which aims to achieve fully automated transactions. In the next iteration, Microgrid members can not only decide whom to buy/sell energy tokens based to or from on their price preferences, but also on other criteria that reflect their environmental or social values.

For instance, a consumer can specify the maximum price he is willing to spend on locally produced renewable energy, but he can also declare other preferences such as percentage of energy they are willing to purchase from local renewable energy or the main grid. Users can even prioritize selling/buying energy from friends, family, or a specific neighbor. The market clearance mechanism is supposed to work similarly to how stock markets work today:

The platform will record the interest of buyers and sellers (bids/offers) in an order book. Users will be able to change their price preferences in real-time.

The locally produced energy will be first allocated to the highest bidders.

The lowest allocated bid represents the market clearing price for each time slot, currently set 15 min intervals.

Users will be able in the future to collect historic information on prices, and therefore learn and adapt their bidding strategies.

Uncertainties & unanswered questions

The Brooklyn MicroGrid project says that it aims to serve as a testbed for exploring novel business models that promote consumer engagement in community projects. Localized energy trading opens the potential for energy cost savings, however, numerous research questions are open for debate. First and foremost, the importance and size of local energy trading markets need to be investigated. Only by implementing large- scale projects that represent diverse conditions in energy markets and social groups, will an accurate determination to participate in similar market architectures be made possible. Pricing in customer-sided markets is determined by the laws of demand and supply, resulting potentially in significant price volatility or even higher tariffs than the ones offered by the main grid. As a result, further work in engagement with and protection of the elderly, socially disadvantaged, and vulnerable from price volatility is required. In addition, equilibrium prices will not only be derived by simple cost functions but by social values and behavior. As a result, individual preferences and social behavior of market participants require further investigation to develop efficient market designs and pricing mechanisms. Other open research questions include the determination of most appropriate time frame for market clearance and data updates, which is increasingly dependent on the operating protocol rules and consensus.

Another crucial issue is that of balancing demand to supply. Currently, existing network infrastructure is used not only to distribute and supply the energy traded in the marketplace, but also to resolve issues caused by RES (a large renewable energy company) intermittency and load balancing.

The future of Microgrid

In the future, the project aims to explore how blockchain could be used for active management of the distribution network. In principle, energy produced by local prosumers can provide additional flexibility for local substation balancing. This is currently not realized in the Brooklyn Microgrid case, although a number of projects have begun exploring the use of techniques from artificial intelligence, machine learning and big data analytics to achieve demand-side flexibility. What blockchains could contribute these solutions is the potential for decentralized matching between prosumers, enabling them to take real-time control of the own energy generation and supply. Please note that MicroGrid has been chosen for the sole purpose to display an existing industrial use case in the energy-sharing economy and is not an endorsement of the company or the project.