In the next section, we will cover the process of tokenization of real-life assets, the concept of NFTs and web3.

Asset tokenization is a process that essentially converts an asset (such as real estate) into tokens that can be distributed, traded, transferred, fragmented, and stored on a distributed ledger technology. Specifically, tokenization is the process of transforming ownerships and rights of assets into a digital form. By tokenization, you can transform indivisible assets into token forms. Such a process is transforming the way how assets can be financed, allowing asset owners to place them on blockchain and distribute in a more technologically advanced and cost-effective way. Tokenization as a blockchain term can be defined as the process of issuing a token on blockchain that represents various real assets (i.e., real estate, company bonds, luxury items etc.).

After the boom of unregulated Initial Coin Offerings (ICOs) in 2018, Security Token Offerings (STO) emerged as a new, more regulated way of raising liquidity for various projects by tokenizing them. This is one such example for tokenization. Tokenized assets can take shape in different forms though. They can be security tokens, platform tokens, utility tokens, fungible, or non-fungible tokens.

Real estate is viewed as one of the main assets that can be tokenized. Traditionally, it was an illiquid asset that was accessible only to a small pool of wealthy individuals, while smaller investors could benefit only from investing in Real Estate Investment Trust (REIT) stocks. However, this is changing rapidly, and more investors will have access to single-asset real estate investments which they can trade as tokens within decentralized exchanges (DEXes). Concretely, this would mean that someone can be 1/25 owner of a house without needing to own the funds to buy the entire house. Asset divisibility, faster and cheaper transactions, higher liquidity in rather illiquid markets and transparency are some of the benefits of tokenization.

To learn more about tokenization, listen to the Generation Blockchain podcast episode on asset tokenization.

Click here to listen to the Generation Blockchain Podcast on Asset Tokenization.

Nonfungible tokens are a blockchain-based, programmable proof of ownership to an asset. This digital proof gives its holder the exclusive ability to use, sell and transfer the asset’s ownership rights, as dictated by their private key signature.

These rights could take different shapes. They can pertain to resale, physical redemption, contain digital functions, financial benefits, or other intangible rights. The NFT does not necessarily “contain” the asset purchased but rather is a programmable record of ownership with an inbuilt pointer to the asset location. For example, if you buy NFT art in the form of a picture, the picture itself is not stored on the blockchain but rather, the link leading to the NFT is stored on chain.

Fungibility refers to the interchangeability of the asset. Bitcoin, Ether (ETH) and fiat currencies are fungible since there is no difference between each unit. One 20€ bill is exactly the same in terms of its value and purchasing power as another 20€ bill despite the fact that they have different serial numbers. “Nonfungible” assets on the other hand are unique and cannot be interchanged seamlessly (e.g., houses or rare art). Nonfungible tokens represent unique assets on the blockchain.

Semi-fungibility is a relatively new term and refers to interchangeability between specific classes of assets. While football tickets can be interchangeable if they are for the same game and same booth or seating area. Note that these types of assets can change in fungibility over their lifetime. For instance, after the semi-fungible concert ticket is used, it becomes a unique, so-called clipped ticket” and is thereafter nonfungible.

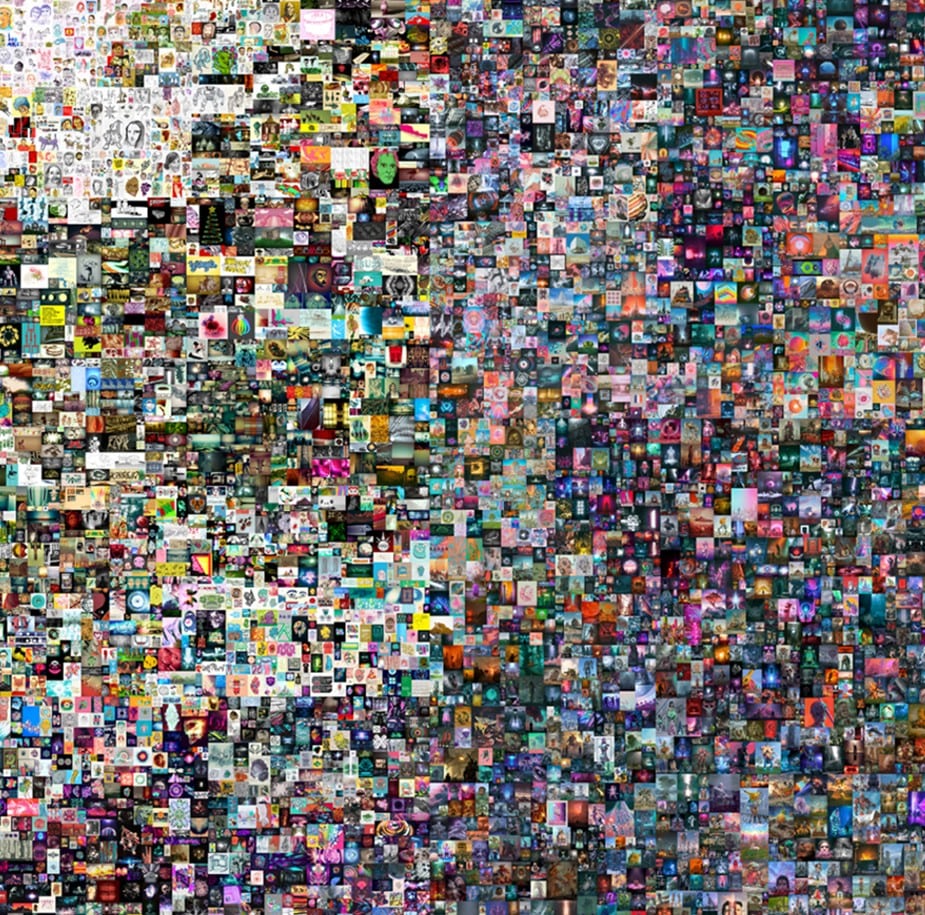

Artist Beeple and his $69 million NFT

The biggest NFT media attention to date was given to the artist Beeple. His digital artwork was sold for $69 million US dollars at an auction at the Christie's auction house in March 2021.

Behind the artist’s name Beeple is the US American Mike Winkelmann. The NFT artwork in question is called "EVERYDAYS: THE FIRST 5000 DAYS" and is a digital collage of a total of 5000 individual artworks created in just as many days. Accordingly, there are over 10 years of work behind the overall artwork, with the actual effort being the creation of a 319-megabyte JPEG file with a resolution of 21,069 x 21,069 pixels. But the entire story behind it is unique: the most expensive NFT work by a modern artist to date, the first NFT auction of its kind at Christie's, and thus the worldwide breakthrough on the art market.

Figure 15: NFT: „EVERYDAYS: THE FIRST 5000 DAYS“ (Source: Beeple)

Origin and development

NFTs have become much more present in the media in recent months. For example, Jack Dorsey's $2.9 million NFT tweet or the sale of the Beeple NFT for $69 million make the headlines of non-crypto-specific magazines and media bringing NFTs closer to a much wider audience. Though NFTS seem to be a completely new phenomenon, the history of blockchain-based NFTs already dates several years back. The first NFT project was in 2012, namely the colored coins on the Bitcoin blockchain.

The so-called colored coins are a concept designed to be layered on top of Bitcoin. Coins can be given additional information before being exchanged. "Coloring" in this context means giving coins specific attributes which turn them into tokens. These tokens can be used to represent anything. Due to lack of monetization of the concept on the Bitcoin blockchain, colored coins did not take flight until today. It was not until the Ethereum Blockchain that NFT gained momentum. In the summer of 2017, the first Ethereum-based NFTs appeared as CryptoPunks.

CryptoPunks

Crypto Punks are 10.000 unique digital 8-bit-style punks, all with unique features created by Larvalabs. Their digital property credentials are stored in the form of ERC20 tokens on the Ethereum blockchain. Each CryptoPunk is

distinguished by individual visual characteristics, so no two are alike. The punks were initially available and distributed for free. All you had to do to get one was pay the associated Ethereum transaction fee.

Figure 16: CryptoPunks by Larvalabs

Because of their hard-cap supply and cult status among early adopters, they are already considered digital antiques. They are still tradable and interoperable with most NFT applications on Ethereum though they have been wrapped into ERC-721 tokens to make them tradable on NFT marketplaces. Technically, the wrapped CryptoPunks are a bit different from the others, but they can be unwrapped back into ERC20 standard once they are purchased from OpenSea, a leading NFT marketplace on Ethereum.

CryptoKitties

In 2017, CryptoKitties became the first mainstream application of NFTs that is also the most remembered NFT in history. CryptoKitties are digital representations of cartoon cats created by Dapper Labs for a blockchain computer game. Each of the cats is unique and thus exists only once on the blockchain. Players could own, breed, and trade kitties.

Figure 17: Example of CryptoKitties (Source: CryptoKitties, 2022)

The allure to the on-chain computer game is that new unique CryptoKitties could be bred by uniting different cats. These newly cats could breed cats could then be auctioned off or sold on the open market similar to how the private pet market works in real life.

The CryptoKitties bubble

The breeding activity attracted speculation and hype. At its peak in 2017, trading volume was around 5.000 ETH and sales of a single CryptoKittie reached amounts of $100.000. This sudden increase of traffic on Ethereum’s network caused the digestion of the network. Ethereum's network capacity at the time was not up to this demand. Trading and breeding CryptoKitties incurred high transaction fees and hours of waiting.

The CryptoKitties bubble had formed from a mixture of hype, speculation, and viral story. The bubble burst soon after in mid-December 2017, when the demand and prices for CryptoKitties dropped drastically. The entire crypto bubble began to burst thereafter, and a several-year-long bear market was ushered in in the entire crypto market.

To learn more about NFTs and their technical set-ups, watch this Generation Blockchain video. Click here to watch the Generation Blockchain video on Smart Contracts & NFTs.

In this section, we will dive into the previous and current developmental phases of the internet (web 1.0 and web 2.0) and finally into the often-proclaimed next phase of the internet – called web 3.0.

Web 1.0 – The internet of information

Though it is hard to imagine, the internet is only about 30 years old (as per 2023). Originally, the internet allowed to share research among academics and governments. Its main function was to act as a big library. In the 90s, the internet was also referred to as the “information web” since it allowed users to access research materials. It even enabled us to contact anyone through email.

Web 1.0 allowed users to browse information and send emails but did not support publishing content for the average user. A group of developers acted as the gatekeepers to the information on the internet. The key offering of Web 1.0 was to share information and contact anyone throughout the world with an internet connection.

Web 2.0 – The internet of interaction

In 2004, Facebook and YouTube revolutionized the web with the concept of user-generated content. From then on, everyone with an internet connection could actively publish their own web content. The internet became democratized with web 2.0. Web 2.0 enabled users to form communities around a central idea, and then mobilize themselves for a common cause.

The Arab Spring movement is a good example of this scenario. Social media played a significant role in facilitating communication among the participants of this movement and allowed them to form a large community. Individuals created something big enough to challenge large power structures with web 2.0 as the tool.

Problems with Web 2.0

The structure of web 2.0 is inherently centralized by hardware and software providers that often hold monopoles or have a few competitors of equal footing. Users only have a choice of which applications to use for social media, banking and dating within a narrow frame. These applications in turn rely on a handful of internet servers causing another layer of centralization.

Centralization & monopolies

We can imagine the internet as a few huge suns (i.e., the servers) that have thousands of smaller planets orbiting around them (i.e., our day-to-day apps). The complete authority or control over the applications and data is centralized at one point (the server). The underlying problem with this architecture here is the lack of ownership of data and power to control and decision making. Our entire experience on Web 2.0 is reliant on central entities granting us access to their applications which can be cut off at any time.

Pictures in a cloud, social media account access, banking access are just some examples to name. Essentially, if the control of a user’s content is defined by someone else, it is not really their content anymore. We know this to be true with posting picture on social media to which we lose the rights of ownership once they are uploaded on the platform and the control over what happens to it and where it is stored.

Data as a commodity

What is even more concerning is the fact that the content and personal data posted online can be monetized by companies to make money and influence democratic processes. The bottom line is that the current internet allows users to publish but owns and monetizes everything the users create. User data is a commodity in web2.0.

Honey pots and information silos

When signing up for online banking, the user must trust that service with their personal data. Online banking is especially sensitive since it requires sharing personal information such as identity cards, addresses and the data of your finances. This big amount of personal information stored in central databases gives a huge incentive for hackers to target those storage servers that act as honey pots. Despite security efforts, centralized databases are vulnerable to digital crimes and security threats.

The role of the servers

Inernet servers as the base layer are among the most powerful entities of the web2.0 infrastructure. Whether you use the internet for social media, dating, business, education or banking, there is only a handful of huge entities that gather our information and have absolute control over the collected data. This is a dangerous amount of power, no matter whose hands it is in, and which regulation is in place to avoid fraudulence.

Value transfer

Additionally, in web 2.0 users cannot autonomously transfer value without a third party involved. This is especially true for cross-border transactions. Despite advancements in digitalization and digitization of online banking, an intermediary or third-party provider is needed, nonetheless.

While web 2.0 allowed users to publish content, build communities, and social movements, it also concentrated the right and control of personal data in the hands of big digital entities. In web2.0 we are not the owners of any content we publish, and users also do not exert “self-sovereignty.”

Web 3.0 – Internet of Ownership

Web 3.0 answers the questions:

What if we could access all services without sharing any of your data, and without handing over the ownership of the content you create?

What if we could own our digital life and manage our assets autonomously?

Web 3.0 (or also referred to as web3) is the proclaimed next generation of internet after web 2.0. The name was created by Gavin Wood, the co-founder of Ethereum and Polkadot's founder. It is also important to note that there is no uniform definition for the term web 3.0 yet. While web 2.0 focuses on user-created content hosted on centralized websites, web 3.0 will give users more control over their online data. To do so, web 3.0 makes use of machine learning, artificial intelligence (AI), and blockchain technology. Web 3.0 proponents aim to create open, connected, intelligent websites and web applications with the help of an improved machine-based understanding of data. The aspects of decentralization and digital economies also play an important role in web 3.0 which is where blockchain technology steps in. That being said, web 3.0 is still far from mass adoption.

Security

A blockchain is essentially an infinite digital storage space that is open to everyone. Blockchain does not compromise on security meaning that it is a safe locker for your digital assets. Blockchain-based assets allow the user to “own” their own data and safeguard it themselves. Blockchain also eliminates the current centralized infrastructure of the internet, data, and assets.

Autonomous value transfers

Since blockchain is a digital ledger that keeps track of value and ownership as it is transferred, users can send and receive value digitally without an intermediary. This allows the next iteration of the web to break out of its current centralized structure and become a safer, fairer, and more efficient space, resulting in financial freedom for users.

The technical side of web 3.0

Just like different programming stacks defined web1 and web2, there is a new software stack that defines web3 to make decentralized internet happen. Web3 is in many aspects an iteration of Web2 in terms of interactivity. The big difference between them is that at the core of the stack there is a blockchain protocol. On top of the blockchain protocol, there are four layers that bind blockchain to the end-user experience:

Smart contracts

Smart contracts are embedded into each data block and tie in NFTs and cryptocurrencies into the web3 concept. While Ethereum is the leading platform for deploying smart contracts written in Solidity there are other blockchains, such as Cardano that use other programming languages such as Haskell.

Web3.0 libraries

Web3.0 libraries provide access to helper methods on how blockchains link to web3 provider dApp interfaces (e.g., ethers.js, web3.js, or web3.py). The web3.0 libraries enable you to build frontends that can communicate with the blockchain (including smart contracts deployed on the blockchain).

Nodes

It is the role of nodes to link web3 libraries to smart contracts as blockchain’s decentralization cornerstones. Instead of relying on a centralized server, blockchain networks are dispersed across thousands of computer nodes worldwide.

Wallets

Wallets connect to blockchain networks and individual dApps on them. Wallets should not be seen as containers. Rather, crypto wallets like MetaMask unlock access to blockchains and their dApps, via the user’s private keys.

With these four web3 layers in play, it is possible to replicate every web2 platform that exists today. They offer the same functionality but are improved in the sense of offering decentralized monetization, funds/data ownership, and censorship-resistant content. In web3.0, 3D visualization and interaction presentation are a big part of the user experience. The fields of UI and UX also work towards presenting information in more intuitive ways for web users. In connection with blockchain, AI can both present data to us and sort it, making it a versatile tool for Web 3.0. This also reduces the work needed for human development in the future.

The edge of web3.0 over web1.0 and web2.0

The combination of Web 3.0’s key features (in theory) can lead to many benefits and differ depending on the exact blockchain calibration:

No central point of control

Since intermediaries are removed from the web3.0 equation, users are controlling their user data. The lack of centralization reduces the risk of censorship by governments or corporations and cuts down the effectiveness of Denial-of-Service (DoS) attacks.

Increased information

interconnectivity

As more products become connected to the internet, larger data sets provide algorithms with more information to analyze. This can help them deliver more accurate information that accommodates the individual user's specific needs.

Increased browsing efficiency

When using search engines, finding the best results have sometimes posed a challenge. However, they have become better at finding semantically relevant results based on search context and metadata over the years. This results in a more convenient web browsing experience that can help anyone find the exact information they need with ease.

Improved advertising and marketing

Web 3.0 aims to improve advertising by leveraging smarter AI systems and targeting specific audiences based on consumer data.

How does crypto fit into web3.0?

Blockchain and crypto play a crucial role in web3.0 since decentralized networks successfully create incentives for more responsible data ownership, governance, and content creation as compared to web2.0. Some of its most relevant aspects for Web 3.0 include the following:

Digital wallets

Anyone can create a wallet that allows you to make transactions and acts as a digital identity. There is no need to store your details or create an account with a centralized service provider. The user has total control over their wallet, and often the same wallet can be used across multiple blockchains.

Decentralization

The transparent spread of information and power across a vast collection of people is simple with blockchain. This contrasts with web2.0 where large tech giants dominate huge areas of our online lives.

Digital economies

The ability to own data on a blockchain and use decentralized transactions creates new digital economies. These allow us to easily value and trade online goods, services, and content without the need for banking or personal details. This openness helps improve access to financial services and empowers users to begin earning with their own data and content.

Interoperability

On-chain dApps and data are increasingly becoming more compatible. Blockchains built using the Ethereum Virtual Machine can support each other's DApps, wallets, and tokens. This helps improve the ubiquity needed for a connected web3.0 experience.

Web3.0 use cases

Although web3.0 projects are still in development, we do have some examples that are already in use today:

Decentralized autonomous organizations (DAOs)

As well as owning your data in web 3.0, web3.0 users can own the platform as a collective, using tokens that act like shares in a company. DAOs coordinate decentralized ownership of a platform and make decisions about its future in a democratic way. DAOs are defined technically as agreed-upon smart contracts that automate decentralized decision-making over a pool of resources (i.e., tokens). Users with tokens vote on how resources get spent, and the code automatically performs the voting outcome. However, people wrongfully define many web3.0 communities as DAOs. These communities all have different levels of decentralization and automation by code.

Connected smart homes

One key feature of web3.0 is its ubiquity. This means that we can access our data and online services across multiple devices. Systems that control heating, air conditioning, and other utilities can now do so in a smart and connected manner.

Siri & Alexa virtual assistants

Both Apple’s Siri and Amazon’s Alexa offer virtual assistants that are interoperable with web3.0. AI and natural language processing help these assistants to get better at understanding human voice commands. The more people use Siri and Alexa, the more their AI improves its recommendations and interactions. This makes it a perfect example of a semantically intelligent web app for web3.0.

Web3 limitations

Despite the numerous benefits of web3.0 in its current form, there are certain limitations that the ecosystem must address for it to flourish:

Accessibility

Web3.0 is less likely to be utilized in less-wealthy, developing nations due to the required high transaction fees. On Ethereum, these challenges are being solved through network upgrades and layer 2 scaling solutions. The technology is underway but is still in need of higher levels of adoption on layer 2 to make web3.0 accessible to everyone.

User experience

The technical barrier to entry to using web3.0 is currently quite high as users must comprehend security concerns, understand complex technical documentation, and navigate unintuitive user interfaces. Wallet providers are working to solve this, but more progress is needed.

Education

Web3.0 introduces new paradigms that require learning different mental models than the ones used in web2.0. A similar education drive happened as web1.0 was gaining popularity in the late 1990s. Proponents of the internet used a slew of educational techniques to educate the public from simple metaphors (the information highway, browsers, surfing the web) to television broadcasts. Web3.0 is not inherently more difficult, but it is different. Educational initiatives informing web2.0 users of these web3.0 paradigms are vital for its success.

Centralized infrastructure

The web3.0 ecosystem is young and quickly evolving. As a result, it currently depends mainly on centralized infrastructure (GitHub, Twitter, Discord, etc.). Many web3.0 companies are rushing to fill these gaps, but building high-quality, reliable infrastructure takes time.