Before we will dive into decentralized finance (DeFi), we must first understand our current financial system on a base level to understand the parallels between traditional finance (TradFi) and DeFi.

Any financial system that we know today is a highly interconnected network of intermediaries, facilitators, and markets serving the following purposes:

Allocating capital,

Sharing risks, and

Facilitating all types of trade, including intertemporal exchange.

On first glance, this might sound uninteresting, but it is one of the most crucial pillars to human welfare in a capitalistic system. Without this financial system, the technological progress of the last two centuries (e.g., invention of steam engines, cars, airplanes, land line telephones, computers, gene manipulation, and cell phones) would not have taken place, at least not at this pace.

The purpose of the financial system

The main function of the system is to efficiently link money borrowers to lenders. Borrowers range from inventors, entrepreneurs, domestic households, governments, businesses, and startups with potentially profitable business ideas but limited financial resources where the expenditures are higher than the revenues. Lenders or savers also come in different calibrations and can take on the shape of domestic households, businesses, governments, and investors with excess funds where the revenues are higher than the expenditures. The financial system also helps to link risk-averse entities called hedgers to speculators. It does happen that individuals and companies, especially small businesses or ones that sell into rapidly growing markets, have enough wealth (i.e., a stock) and income (i.e., a flow) to implement their ideas without outside financial support by plowing back profits which is also known as internal finance.

The more usual case, however, is that people and firms that have good ideas do not have the funds needed to draw up blueprints, create prototypes, lease offices or production space, pay employees, obtain permits and licenses, or suffer the risks that come with bringing a good or service to market.

Sufficient funds are vital to chasing and fulfilling our ideas from a professional and private standpoint. This course on blockchain for example is free because the EU deems education to be a necessity that should not be made available only for those students who have the means to pay for it.

The necessity of a financial system (?)

Why is it that individuals and companies do not simply borrow from other individuals and companies when they have to?

Lending, as goes for most other goods and services, is most efficient and cheap if done by specialists and companies that focus on doing only one thing (or a couple of related activities) very well. Firstly, through the practice, research that they have accrued over time and secondly, they also unlock economies of scale. For example, the fixed costs of making loans (i.e., advertising for borrowers, buying and maintaining computers, leasing suitable office space, and writing up contracts) are quite high. To make up for these fixed costs and make a large margin of profit, lenders must do a lot of business. Therefore, small businesses in a highly concentrated market cannot be profitable. This is not to say, however, that bigger is always better, only that to be efficient financial companies must exceed minimum efficient scale.

Asymmetric Information

Finance also suffers from another problem that is not easily overcome, namely the concept of opportunity costs (i.e., to obtain X you must give up Y). On top of this, we encounter an additional issue called asymmetric information. In the context of a financial system, when a seller (i.e., borrower, a seller of securities) knows more than the buyer (i.e., lender or investor, a buyer of securities), it is not long until the problems start to show. The two main issues with this are adverse selection before a contract is signed and moral hazard, which entails sinning after contract consummation.

Adverse selection

Ironically, the riskiest borrowers are also the ones who most strongly demand loans. If lenders are unaware of this selection bias, they will continuously become more and more reluctant to lend out their money. Unless recognized and effectively countered, moral hazard will lead to the same suboptimal outcome.

Moral hazard

Even if adverse selection bias did not cause a problem, borrowers that are good willed sometimes turn into thieves after signing because they realize that they can gamble with other people’s money. This kind of embezzlement is common, and borrowers often end up unable to repay the loan.

The current financial system never kills the information asymmetry, but it reduces its influence, intermediaries by screening insurance and credit applicants and monitoring them thereafter, and markets by providing price information and analysis. Businesses and other borrowers can obtain funds and insurance cheaply enough to allow them to become more efficient, innovate, invent, and expand into new markets despite asymmetric information. Another way to look at it is to realize that the financial system makes it easy to trade intertemporally, or in other words across time. Instead of having to pay immediately for supplies, companies leverage the financial system to acquire what they require for operations today and pay for it at a defined time in the future, giving them time to produce and distribute their products.

Financial Instruments

Financial instruments are legally binding contracts that list the obligations of their makers, the individuals, governments, or businesses that issue them and promise to make payment, and the rights of their holders, the individuals, governments, or businesses that currently own them and expect to receive payment. They serve the purpose of specifying who owes what to whom, when or under what conditions payment is due, and how and where any payment should be made.

Financial instruments take mainly three shapes:

Debt

Debt instruments, such as bonds, are a lender–borrower relationship in which the borrower promises to pay a certain sum and interest to the lender at a specific date or over some period of time.

Equity

Equity instruments, such as stocks, represent an ownership stake in which the holder of the instrument receives some portion of the issuer’s profits.

Hybrid

Hybrid instruments(e.g., preferred stock) have some of the characteristics of both debt and equity instruments. Like a bond, preferred stock instruments promise fixed payments on specific dates but, like common stock, only if the issuer’s profits warrant. Convertible bonds, by contrast, are hybrid instruments because they provide holders with the option of converting debt instruments into equities.

Today, most financial instruments are held only as electronic accounting entries that are linked to a specific contract. Stocks used to be issued in paper form.

Financial Markets

The current financial system is not a direct financial system. There is always an intermediary needed to settle a transaction unless the transaction is made in physical cash. For example, brokers facilitate secondary markets by linking sellers to buyers of securities in exchange for a fee or a commission, a percentage of the sale price. Dealers “make a market” by buying and selling securities, profiting from the arbitrage, or the difference between the sale and purchase prices. Brokerages offer usually both – brokering and dealing and also consult their customers on investment decisions. Investment banks support primary markets by underwriting (i.e., buying for resale to investors) stock and bond offerings and by arranging direct placement of bonds. Investment banks can also be brokers by introducing securities issuers to investors.

As are financial markets, financial intermediaries are highly specialized. Financial intermediaries have very different functions from depositing money, giving advice, making use of different prices for the same asset at a certain time and many others. They are usually categorized according to their ownership structure. For example, depository institutions (i.e., commercial banks, savings banks, and credit unions) issue short-term deposits and buy long-term securities. Traditionally, commercial banks specialized in issuing demand, transaction, or checking deposits and making loans to businesses. Savings banks issued time or savings deposits and made mortgage loans to households and businesses, while credit unions issued time deposits and made consumer loans. Almost all commercial and many savings banks are joint-stock corporations. Some savings banks and all credit unions are mutual corporations and hence are owned by those who have made deposits with them. The current financial market is highly complex and is the result of years of developments.

Regulation

The financial system is relatively heavily regulated as compared to other sectors in capitalistic countries. Regulators serve four major functions:

Reduce asymmetric information

They try to do so by encouraging and claiming transparency. That usually means requiring both financial market participants and intermediaries to disclose accurate information to investors in a clear and timely manner.

Protect consumers

Regulators must protect consumers from scammers, and from the failure of honest but ill-fated or poorly run financial institutions. They do so by directly limiting the types of assets that financial institutions are allowed to do business with and by mandating minimum reserve and capitalization levels.

Strive to promote financial system competition and efficiency

Regulators promote competition by ensuring that the entry and exit of firms is as easy and cheap as possible.

Ensure soundness of the financial system

It is the goal of the regulator to ensure the soundness of the financial system by acting as a lender of last resort, mandating deposit insurance, and limiting competition through restrictions on entry and interest rates which is a controversial intervention in the market.

Regulators are also capable of limiting competition in the market to ensure safety. However, this does extend privileges to existing institutions over new ones which is why existing companies are often proponents of regulation.

Depending on the jurisdiction, there is usually more than one local regulator that needs to be complied with. In the US for example, there is the Securities and Exchange Commission (SEC, which oversees exchanges and OTC markets), the New York Stock Exchange (NYSE, which oversees itself as an SRO or self-regulating organization), and the Commodities Futures Trading Commission (CFTC, which oversees futures market exchanges) monitor and regulate financial markets. Next to these three major ones, there are also other regulators, including the Office of the Comptroller of the Currency (which oversees federally chartered commercial banks), the Federal Deposit Insurance Corporation (FDIC, which oversees almost all depositories), and sundry state banking and insurance commissions which is monitoring financial intermediaries. Players that try to avoid regulatory scrutiny due to its high cost tend to use intermediaries instead of markets.

Promising to enhance access and efficiency within financial services, DeFi has gained significant attention (and some traction in the marketplace) in recent years. In essence, DeFi uses secure blockchain technology to facilitate peer-to-peer financial transactions, including borrowing, lending, and trading. DeFi seeks to disintermediate and decentralize the traditional financial services industry by automating complex financial processes. The functional roles of trusted third parties such as brokerage firms, banks, and other centralized financial institutions, are replaced by smart contracts. Although from a big-picture perspective DeFi is still a niche phenomenon whose long-term impact on the financial services industry is yet to be determined, that potential for disintermediation means it is important that established financial institutions understand how it might reshape the operational landscape and how they might themselves embrace the concept of decentralization. Certainly, a major market correction is underway in the digital assets space in 2022.

There is already a broad range of financial services or products available in the DeFi space including trading, lending, investing, deposits, and payments services.

Furthermore, decentralized applications are highly modular. This means, that very often they can be combined and are interoperable to create new applications. DeFi’s rise in popularity can be partly explained by real and perceived structural issues with the current financial services industry. DeFi arose out of a desire to free financial services from the control of centralized institutions and governments discussed in the previous section, thereby providing financial inclusion for more people. Proponents of DeFi argue that traditional financial services are dominated by large institutions and often characterized by tightly controlled access, leading to organically grown inefficiencies, high and opaque fees as well as financial exclusion. In addition, they point to the high level of regulation fostering an environment that is generally hostile to disruptive technologies or innovative business models in most of the world. While some industry commentators have cast doubt on the sustainability of fully decentralized financial services, others believe that DeFi has real potential as a disruptor of traditional financial services markets.

The layers of DeFi

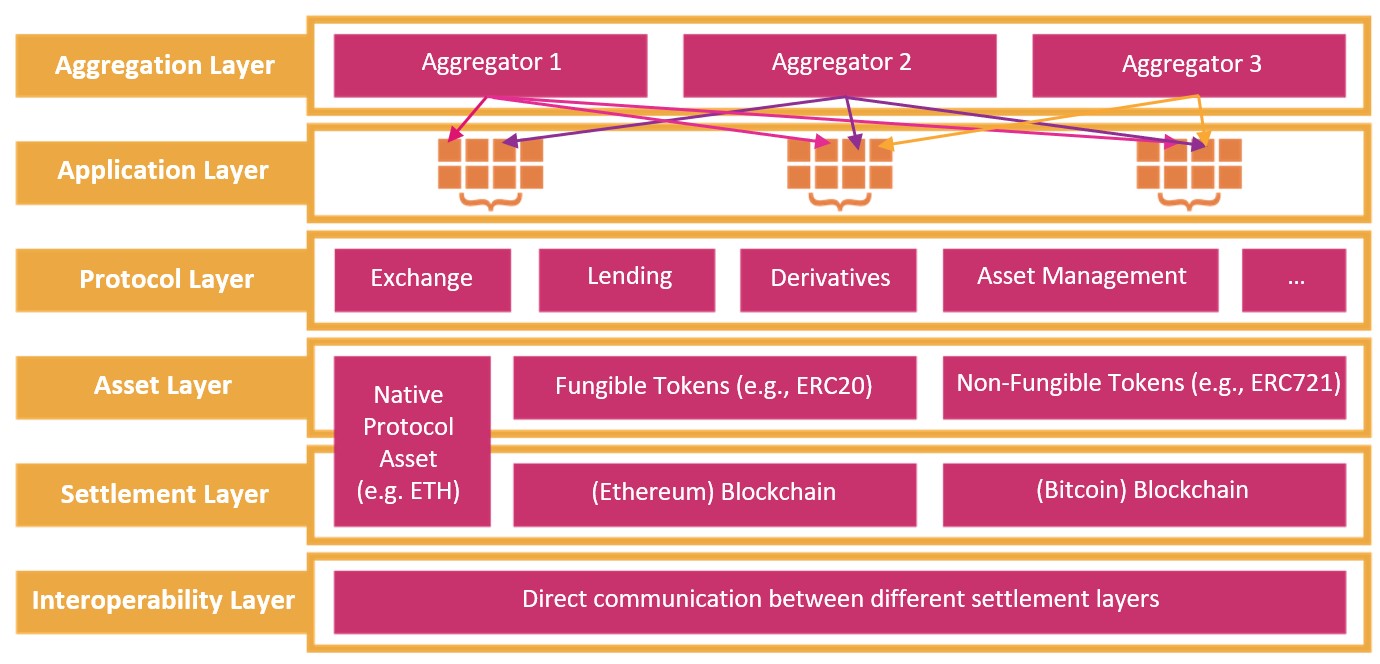

A basic understanding of the different layers of technology used for DeFi applications will establish a mental map that is helpful in analyzing and evaluating specific DeFi implementations as shown below.

Figure 9: The DeFi Stack (based on IOSCO 2022 and Schär 2021)

Protocol, asset, and settlement layers form the core of the DeFi technology stack. The protocol layer consists of DeFi applications that offer some sort of financial service functionality such as trading or lending. The asset layer defines which digital assets can be processed by a DeFi protocol. It is important to keep in mind that normally a specific DeFi protocol is offering its services for only a few specific digital assets such as one fungible token or a pair of fungible tokens. Finally, the settlement layer forms the underlying infrastructure. DeFi applications as well as digital assets reside on Layer-1-protocols (e.g., Ethereum).

This Layer-1 protocol is of crucial importance, as it represents the execution and settlement layer for any transactions. In addition to these core layers, three additional layers can play a role. First, at the bottom of the stack, the interoperability layer allows different settlement layers to directly communicate with each other. It can be used to allow DeFi applications to incorporate different Layer-1-protocols into their functionality.

At the top of the stack, an application layer normally provides user interfaces. Finally, an aggregation layer allows to aggregate the functionality of multiple DeFi applications.

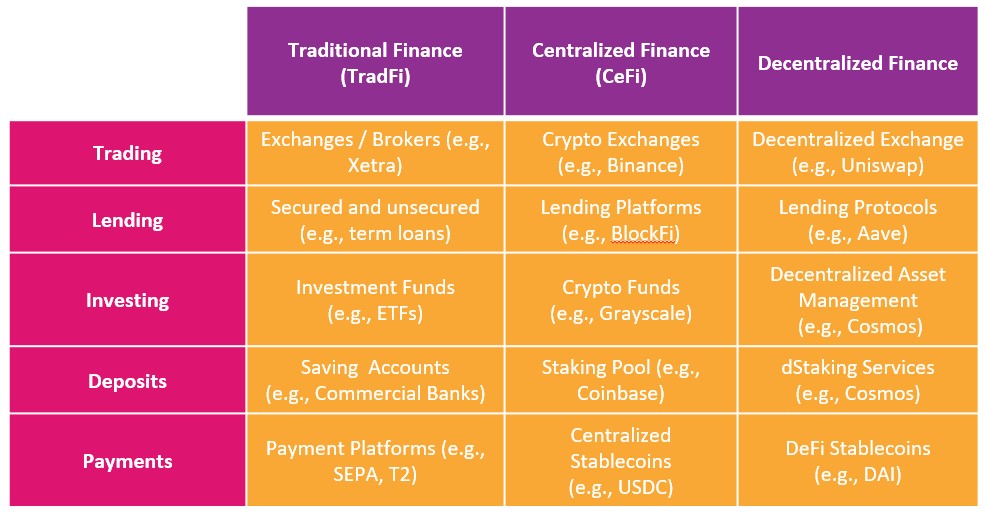

DeFi solutions exist for major functions such trading, lending, investing, deposits, and payments more services being added on an ongoing basis. Below you see an overview of financial services, with examples of solutions across traditional finance (TradFi), Centralized Finance (CeFi) and DeFi. When comparing TradFi with CeFi and DeFi, it is important to distinguish infrastructures from assets. DeFi (and CeFi) solutions currently focus on the processing of digital assets such as cryptocurrencies, whereas TradFi handles traditional assets such as bonds or equities. However, it would also be conceivable that DeFi solutions process digitalized versions of traditional assets (e.g., tokenized bonds).

Figure 10: Main financial services categories in traditional finance, centralized finance, and decentralized finance.

As noted, DApps are currently available for users in financial services such as trading, lending, investing, deposit, and payment solutions.

Trading:

In DeFi, decentralized exchanges (DEXs) perform the function of centralized exchanges by using smart contracts. DEXs enable users to exchange digital assets without having to use or trust intermediaries or use custodians. Major DEX protocols include Uniswap and Sushiswap.

Lending:

DeFi lending protocols offer loan services. These solutions normally come in one of two varieties. With pool-based lending protocols, interested individuals provide liquidity or funds to a pool that others can borrow from.

Users putting their assets into the pool can earn interest-like income in return. With peer-to-peer based lending, individuals borrow directly from a particular lender. In this case, decentralized lending protocols enable borrowers to take out loans with minimum barriers. Major DeFi lending protocols include Aave, Maker and Compound.

Investing

DeFi DApps can also be used to execute automated trading strategies. For example, TokenSets is a DApp-based platform for portfolio management. Users provide the boundary conditions and investment objectives and then TokenSets trades, balances, and implements strategies to achieve the users’ goals automatically. This enables users to gain exposure to a basket of digital assets, without the need to buy individual assets.

Deposits (Staking)

While there are no deposits in the traditional sense in the DeFi ecosystem, a very similar mechanism (called staking) exists. Staking is the process of locking up digital assets for a fee. It is thus comparable to depositing money at a regular bank. Just as a bank deposit represents a short-term loan that is given to the bank, staked cryptocurrencies can be seen as a short-term loan to a protocol. For the time that assets are staked, they earn a small income. However, they cannot be sold or otherwise used by their owners during this time. Digital assets that are locked up in this way are usually used for adjacent processes (e.g., supporting the transaction validation mechanism of the underlying blockchain network).

Payments and stablecoins

The high volatility of cryptocurrencies such as Bitcoin and Ether hampers their use for payment purposes. This is where stablecoins come in. Stablecoins are digital assets that are pegged to (a basket of) fiat currencies or some other stable asset. They aim to be a means of payment with a similar volatility as fiat currencies. As stablecoins are digital assets, they can be seamlessly integrated into other DeFi applications. Users can conduct on-chain transactions with these coins without the need for using traditional financial infrastructures within a matter of seconds. Stablecoins come in different varieties:

Asset-backed stablecoins are blockchain-based tokens that have their value pegged to a reserve asset such as another digital currency, fiat money, or a commodity. In contrast, algorithmic stablecoins try to keep a stable value by managing the supply of the coin based on demand from users. However, the recent collapse of Terra (Luna) has proven that algorithmic stablecoins have difficulty retaining their value and are rather unsuitable as a means of payment.

Also, the adequacy of reserves of asset-backed stablecoin projects have recently been publicly challenged. Some of the most popular stablecoins include USD Coin (USDC), Binance USD (BUSD) and Dai (DAI). In additon to these private sector-driven stablecoins, central banks around the world are looking into the opportunities of Central Bank Digital Currencies (CBDC) that can include the launch of a stablecoin. While the above examples represent the main solutions currently observed in the DeFi space, there are many other DeFi financial services that are tested (e.g., insurance services, derivatives, and prediction markets).

Decentralized Exchanges

One of the fastest growing areas in DeFi is Decentralized Exchanges (DEX). With the rise of cryptocurrencies and other digital assets after the financial crisis of 2008, users were looking for service offerings that enabled them to trade these new asset classes. Traditional financial service providers did not offer trading services for owners of digital assets. As a result, a new class of financial intermediaries emerged. In the beginning phase, this took shape in centralized exchanges (CEXs). CEXs replicate offers from TradFi in the CeFi world. To use the services of a CEX, a user undergoes registration at the CEX (i.e., KYC and AML processes) and then, before buying or selling digital assets, the user must fund their account using either cryptocurrencies (e.g., Bitcoin) or some traditional form of payment (e.g., bank transfer). This recentralized approach to DeFi means giving up control over any assets. Essentially, the CEX controls the user’s account. In the context of CEXs, users need to trust the exchange with their money.

There is already a broad range of financial services or products available in the DeFi space including trading, lending, investing, deposits, and payments services.

This makes them vulnerable to a certain degree of counterparty risk. At the beginning, this was especially problematic given most CEXs were newly established entities with untested operations and minimal to zero oversight from financial markets authorities. As a results, hacks, scams, and other illegal activities have been common in the early years of the CeFi space, often leading to a loss of capital for users of these services. You will learn more about the early phases of exchanges in a later module. To solving this issue, decentralized exchanges (DEX) emerged. The primary goal of a DEX is full disintermediation via the elimination of middlemen and allowing every user to deal directly with other users on a peer-to-peer basis. By migrating trading functionality directly onto the blockchain via smart contracts, a DEX serves as a trustless platform for the trading of digital assets. Much like traditional exchanges and CEX, these platforms coordinate supply and demand from many users. However, assets either remain in the custody of the user or (for a limited time) in an escrow account of the fully automated smart contract.

Main Types of DEXs

DEXs come in different forms. Over the years, several designs have been suggested and implemented, all to improve on previous projects and further streamline the functionality of the solution and its user experience. The following three major types of DEX exist:

Automated Market Makers-based DEXs (AMMs)

AMMs utilize pools of digital assets which are sourced from so-called ‘liquidity providers’ to enable trading services for their users. Prices are quoted automatically by the underlying smart contract, hence the name automated market maker. The main purpose of creating an AMM is to always ensure liquidity.

Order book-based DEXs

Order book DEXs compile the details of all open buy and sell orders for a particular pair of digital assets. A buy order implies that a trader desires to bid for an asset at a given price. A sell order on the other hand is an indication that a trader is willing to sell a specific asset at a particular price. Much like traditional exchanges, order book DEXs match these orders.

Hybrid / Alternative Platforms While most DEXs can be classified as either AMM or order book-based, a growing number of platforms are beginning to merge the concepts of both these types to create new, hybrid DEXs. This is done to enable additional functionality (i.e., allowing users to seamlessly trade their assets across multiple blockchains).

In addition, a noteworthy phenomenon has been the rise of DEX aggregators, which allow users to search for prices and liquidity across multiple DEXs. As the name implies, they aggregate liquidity from different DEXs to provide the users with the best execution price available within the shortest time, while lowering the level of slippage on large orders and optimizing fees.