By S.Anusuyadevii

Micro finance is providing financial services such as micro loans, collection of thrift, pension,

insurance etc. Micro loans are provided to the marginalized segment to finance new business,

paying urgent family needs etc., without any collateral and the repayment is done based on the

income generated from the business done by the borrower and periodicity of loan repayment can

be weekly, fortnightly etc. As per World Bank data, close to 1.7 billion people across multiple

countries do not have access to basic financial services1. Hence, MFIs play a major role.

In India, Micro finance activities are being carried out by scheduled commercial banks, small

finance banks, Urban co-operative banks, Regional Rural Banks, NBFC-MFIs and other MFIs (not

for profit organizations).

Microfinance has grown in size, outreach and financial growth over the past two decades.

The outstanding loan portfolio of Micro Finance sector as on March 31, 2021 is Rs. 2.59 lakh

crore excluding Self-help Group linked Bank lending. The share of the players are as follows:

scheduled commercial banks (43.67%), small finance banks (15.87%), NBFC-MFIs (31.05%),

NBFCs (8.35%) and others (1.04%) and the average loan size for the year 2020-21 is Rs. 34,641/-.

The objective of the article is to discuss sources of funding available for the NBFC-MFIs,

difficulties faced in securing these funds and exploring whether blockchain technology can

used as a facilitator for securing funding by MFIs. The scope can be extended to other

microfinancing arms such as Section 25 companies who may not have access to funding with

ease.

NBFC-MFI is a non-deposit taking NBFC with minimum net owned fund of ₹5 crore (₹2 crore for

NBFC-MFIs registered in the North Eastern Region) and having minimum 85 per cent of its net

assets (assets other than cash, bank balances and money market instruments) in the nature of

‘qualifying assets’.4 The average credit dispensed to an individual borrower NBFC-MFI is

approximately Rs.34,125/-

The role of MFIs is to lend small ticket loans to borrowers from the marginalized sections who

otherwise do not have a chance to be part of traditional banking channel. To lend money to its

borrowers, MFIs need access to funding. Since they are non-deposit taking NBFCs, they cannot

accept deposits from public which thereafter can be used for onlending. Therefore, the sources

of funding, broadly, include own capital, loans from banks, funding by big NBFCs, raising fund

through securitization of their loan portfolio, funding from bilateral or multilateral organizations,

private investors, subsidies and grants, External commercial borrowings etc.,

1. https://www.bankbazaar.com/personal-loan/microfinance-institutions.html

2. NBFC-MFI definition – Page No 9- RBI- CONSULTATIVE DOCUMENT ON REGULATION OF MICROFINANCE dated Jun 14, 2021

3. Page 7 -Micrometer data as on March 31, 2021

One of the funding avenue available for MFIs is from Banks. Banks can fund MFIs to meet their

priority sector targets. Priority sector norms are applicable to every Commercial Bank [including

Regional Rural Bank (RRB), Small Finance Bank (SFB), Local Area Bank] and Primary (Urban)

Co-operative Bank (UCB) other than Salary Earners’ Bank licensed to operate in India by the

Reserve Bank of India. As on date, Priority sector lending norms for Commercial Banks, Urban

Co-operative Banks and Foreign banks 40 per cent of ANBC or CEOBE whichever is higher as

applicable as on the corresponding date of the preceding year. For RRBs and Small Finance

Banks, it is 75 per cent of ANBC or CEOBE whichever is higher as applicable as on the

corresponding date of the preceding year.

Priority sector lending norms require scheduled commercial banks to allocate 40% of the total net

bank credit as on 31st March to priority sector advances which includes 10% of the priority sector

advances or 10% of the total net bank credit, whichever is higher going to weaker section. These

targets can be met by methods such as lending by the banks themselves to priority sectors,

extending credit to registered NBFC-MFIs and other MFIs (Societies, Trusts etc.) which are

members of RBI recognised SRO for the sector, for on-lending to individuals and also to members

of SHGs / JLGs on-lending to individuals under respective priority sector categories. Banks can also purchase Priority Sector Lending Certificates (PSLCs) from other banks to achieve the

priority sector lending target and sub-targets in the event of shortfall or by investments in

securitized assets originated by MFIs or assignment /outright purchase of eligible priority sector

loans from MFIs.

4. NBFC-MFI definition – Page No 9- RBI- CONSULTATIVE DOCUMENT ON REGULATION OF MICROFINANCE dated Jun 14, 2021

5. Page 29 -Micrometer data as on March 31, 2021

6. 40 per cent of ANBC or CEOBE, whichever is higher (as on March 31, 2020), which shall stand increased to 75 per cent of ANBC or CEOBE,

whichever is higher, with effect from March 31, 2024

7. Master Directions- Reserve Bank of India (Priority Sector Lending – Targets and Classification) Directions, 2020

As per Micrometer data as on March 31, 2021, among the funding instruments used by NBFC

MFIs, term loans contributed 70.80% of the debt outstanding, followed by debentures at 20.7%,

sub-debt at 4.1%, commercial papers at 0.4% and other instruments 4.0% and smaller entities

appear to rely on term loan for smaller entities. As the size of institution increases, diverse option

of funding become available to these institutions.

Micrometer data for the year FY 20-21 states that during FY20-21, NBFC- MFIs (based on a

sample of 52 NBFC MFIs) received a total of Rs 40,797 Cr in debt funding from Banks and other

Financial Institutions. 67% of debt funding for Large MFIs was from Banks. Medium MFIs were

able to source 32% of their funding from banks and remaining (68%) from other FIs. Small MFIs

received 24% of their debt funding from Banks.

As per Micrometer data for the year FY 20-21, out of the borrowings received during FY20-21 by

54 NBFC MFIs, Other Banks contributed to 46.9% of the borrowings followed by 20.4% from non-Bank entities, 18.5% from top 5 banks, and 13% from AIFIs , 0.9% from ECB and 0.4% from

Others. However, for Small MFIs no borrowing was received from AIFIs and top 5 banks.

To access the capital market such as debt funds, Small and mid-sized NBFCs need to get desired

level of credit rating. FIDC in its letter stated the following with respect to accessibility of capital

marker by NBFC MFIs : Given the size of these NBFCs, their credit rating makes them ineligible

for funding. “All the credit rating agencies use the same scale to rate both large and small NBFCs.

In such a scenario, it is practically impossible for a small sized NBFC to get the desired level of

credit rating despite a sound balance sheet and excellent track record. Sometime banks have

been risk averse in lending to NBFCs, except for the large NBFCs which have a good parentage

and are of a certain size…Further, banks may not lend once their sectoral exposure caps is met.

Though mutual fund and insurance companies can lend to NBFC sector, due to risk aversion they

may also not lend when needed.

One of the reasons for inability to access funds by small and medium NBFC MFIs is risk aversion

on the part of lenders such as banks, mutual funds and insurance companies etc., The reason

could be lack of access to loan portfolio data that can be verified so as to make proper credit

assessment by the lenders. In this article, we will explore whether this issue can be addressed

using blockchain. Before we dwell onto how block chain can be utilized for the extant problem, an

introduction of block chain may be of order.

8. Business Standard July 17, 2020

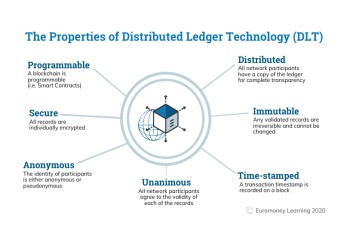

Block chain: Blockchain is a system of recording information in a way that makes it difficult or

impossible to change, hack, or cheat the system. A blockchain is essentially a digital ledger of

transactions that is duplicated and distributed across the entire network of computer systems on

the blockchain. Each block in the chain contains a number of transactions, and every time a new

transaction occurs on the blockchain, a record of that transaction is added to every participant’s

ledger. The decentralised database managed by multiple participants is known as Distributed

Ledger Technology (DLT).

The cryptographic protocols along with consensus algorithm makes sure that the network is safe

and all the data is good. Blockchain’s immutability feature ensures that no data is changeable

once it is written. Other key features of blockchain technology include transparency and trust.

A diagram of block chain is given below:

9. Euromoney learning

Evolution of blockchain technology enabled Block chain technology to be leveraged by the

enterprises leading to permissioned block chain. Multichain, Ripple, R3 Corda , Hyperledger etc.,

are the permissioned blockchain solutions to meet the needs of enterprises where privacy of data

is important whereas in public blockchain, the data is not private.

The permissionless or public blockchains require no permission to join or interact with it. Bitcoin,

Ethereum etc. are public chain. Users can create a personal address and then interact with the

network by either helping the network to validate transactions or simply send transactions to

another user on the network. The trust is that the state of transaction is immutable and this is

maintained through mining native currency to reward the miners who add the block or to pay by

those who want their transactions to be added to the network. The characteristics of the block

chain are pseudo anonymity, time-stamped, immutable, distributed, secure and unanimous as it

is based on consensus protocol incorporated in the blockchain.

Permissionless blockchains may not be of a solution for enterprise use cases where data privacy

is an important factor. Hence, the need for permissioned block chain arises where though the

underlying technology of blockchain is used, access to the network is based on the permission

given.

Permissioned blockchains, on the other hand, operate a blockchain amongst a set of known,

identified and often vetted participants operating under a governance model that yields a

certain degree of trust. A permissioned blockchain provides a way to secure the interactions

among a group of entities that have a common goal but which may not fully trust each other.

The problem of small and medium NBFC -MFIs is difficulty in accessing funds from mutual funds

or insurance companies and also from banks who have enabling regulatory provision to lend it

to them either in the form of loans or for onlending to priority sector or through purchase of

securitized assets of underlying good priority sector loans. Lenders are wary of lending to small

and medium MFIs as they do not have full visibility to the quality of these MFIS portfolio. Small

and Medium MFIs are unable to tap the capital market as they are not in a position to get

investment grade rating from the rating agencies.

In this context, it may be mentioned that as per para 100 of Master Directions of Non Financial

companies issued by RBI10, NBFCs having customer interface have to become member of all four

Credit information companies who maintain a separate MFI bureau to capture credit history of

borrowers of NBFC-MFIs.

Since the MFIS need to maintain and update the credit information of all its customers on monthly

basis, we may explore whether this data can be leveraged to seek fund from banks or other

lenders using Permissioned block chain. It may be mentioned that RBI has accorded SRO status

to two entities, namely,, MFIN and Sa-DHan. Though role of Self-Regulated organization is to

support member NBFC-MFIs in adhering to regulatory and industry standards, with focus on

customer welfare and protection, we may explore whether role can be leveraged to onboard the

MFI data in the permissioned block chain concept.

To address the lack of data for potential lenders to make informed decision about funding to a

small or medium MFI, it is proposed to use the credit information data made available to CICs

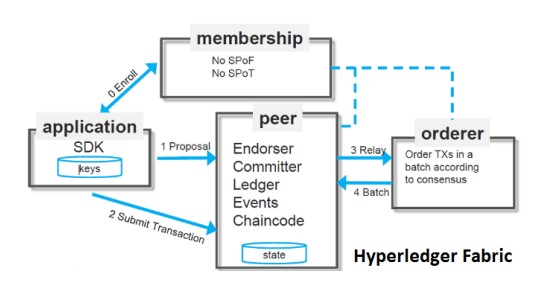

and to leverage the concept of permissioned block chain such as Hyper Ledger fabric. Though

there are other permissioned block chain networks such as R3 Corda etc., are available, the

features of Hyperledger fabric are used to highlight the use case for MFI funding.

Hyperledger fabric is designed for enterprise purpose blockchain network, wherein every

participant has their own replicated copy of the ledger. In addition to ledger information being

shared, the processes which update the ledger are also shared. Unlike today’s systems, where a

participant’s private programs are used to update their private ledgers, a blockchain system

has shared programs to update shared ledgers.

10. https://m.rbi.org.in/scripts/BS_ViewMasDirections.aspx?id=10425

11. https://hyperledger-fabric.readthedocs.io/en/release-2.2/whatis.html

On the one hand, we have listed out some of the enabling regulations for MFIs to share data

with CRCs. We have SROs who have MFIs can onboard with them. We have banks who

need visibility to loan portfolio of MFIs to decide on lending to MFIs so as to meet PSL targets/

expand their business and we have MFIs who welcome fund to run their business.

On the other hand, we have listed out features of permissioned blockchain such as distributed

ledger across nodes, append-only nature, establishing immutability with cryptographic

techniques, smart contract to update information and provide access to information ,

consensus mechanism to ensure that ledgers are updated only after transactions are

approved and also the order in which the transactions are to be updated, security and

membership services, chaincode(smart contract) and asset (Asset definitions enable the

exchange of almost anything with monetary value over the network).

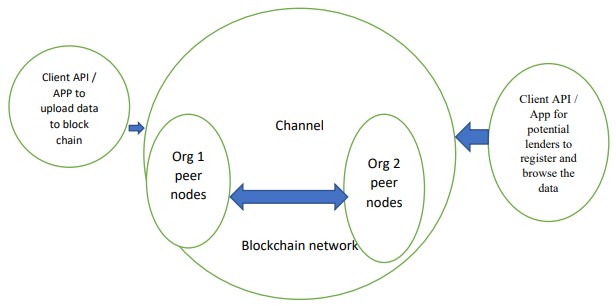

Using the above factors, a solution is proposed in which we consider two organizations,

namely, Sa-DHan and MFIN as consortium members of block chain. They in turn act as an

aggregator for MFIs who are their members.

The SROs maintain peer node wherein the data relating to each MFI is maintained. Each SRO

will have an identity in the block chain. Using client API, the MFIs who are members of these

SROs will upload credit information details of their borrowers on monthly basis as hitherto. (since

data needs to be uploaded to Credit information companies on monthly basis, a copy of the same

can be uploaded to the SRO in which it is a member through the web portal to blockchain). To

address the concerns of privacy and security of the borrowers’ information, customer related

information related field can be blocked out by the MFI before uploading data to SROs. These

fields can be hashed as Hyperledger permits hashing of data so that data can be kept private.

The SRO in turn updates its ledger data of that MFI. Since there is no transaction between the

peer nodes (i.e Sa-DHan and MFIN), endorsement by the updating peer is enough to update the

data in the ledger which gets synchronized with other SRO which has a peer node in the

blockchain. The ledger data will be having name of the MFI, loan outstanding, default or regular

status and filtering can be done to remove any stale data of assets. Smart contract to filter such

details may be built and deployed. If a MFI who is a member of one SRO does not want its data

to be visible in another SRO node, the identity related to MFI can be hashed and the ledger state

can be updated accordingly in the non member SRO node.

A front-end utility (APP) can be provided by the blockchain consortium with a viewing rights to

banks or different types of lenders or venture capitalists who seek access to such information.

The lenders can browse the credit portfolio of a MFI by browsing the credit history of its borrowers

and generate reports by fetching data from block chain. Details of customer such as name, Aadhar

ID, etc would not be revealed as these would be blocked out in the blockchain. This will enable

small and Medium MFIs to show their asset quality and access funds from various categories of

lenders such as Mutual funds, banks, foreign lenders etc., and they will be in a position to price

their lending to MFIs based on the asset quality reflected from the data maintained in the

blockchain. Any additional fields that may be of value can be incorporated in the ledger state. As

per RBI regulations, MFIs can access foreign funds. Having a web interface or APP for the banks

and overseas investors will help the fund providers to browse the asset quality of the MFIs. These

data would not be made available to competitors. This would be on need to know basis with proper

credential access to the various categories of lenders who register for such access in the portal.

This facility can be used to onboard SHGs and other MFIs such as Societies and Trusts who are

not regulated by RBI ,and therefore, do not have to report credit information details to MFI bureau

of CICs and they can upload their data also to SROs with whom they are registered and their

portfolio also can be viewed by the various lenders and NBFCs who lend to MFIs and informed

decision can be taken regarding lending and pricing and this opens up avenues for micro finance

groups that have no access or limited access to formal funding channel to access fund from the

banks and NBFCs.

As regards cost of implementation, currently, a MFI needs to make aggregate data available to

the prospective lenders/investors. Also, prospective lender/investor may expect the data to be

audited before arriving at a decision regarding investment. This involves manpower cost for data

collection and presentation and auditing fee on the part of MFI. However, the Hyperledger fabric

is an open source and it has community edition which can be used free of cost by the SROs.

Though there may be one-time cost of implementation with respect to hardware, cost can be

offset as data would be verified one on block chain which inspires confidence for the prospective

investors/lenders. Further, recurring cost of collation of data and audit can be eliminated.

The MFIs in various categories play a major role in reaching out the unbanked segment of the

society through micro lending. In order to serve the segment well at a cost affordable to them,

raising funds at an affordable cost and with ease is important for them. Using block chain

technology, both lender and borrowing institutions can be brought on board on a single platform

with ease and the data of microfinance institutions can be leveraged to enable objective analysis

of the data and make funding available with ease at an affordable rate to MFIs. This will enable

MFIs to lend at an affordable rate to their borrowers thereby creating a win-win situation for all

stake holders concerned.

i. The author works for Reserve Bank of India and the views expressed in the article are her own and not the views of the Reserve Bank of India.