Blockchain technology has the potential to revolutionize various aspects of our daily lives by providing secure, transparent, and decentralized solutions to long-standing problems. Here are some ways that blockchain can benefit the average person:

Secure Digital Identity: One of the most promising applications of blockchain technology is in the realm of digital identity. With the growing number of online services and data breaches, it has become increasingly important to have a secure and reliable digital identity. Blockchain technology can provide a decentralized solution to this problem by allowing individuals to control and manage their digital identities, making it much harder for hackers to steal personal information.

Decentralized Finance: Blockchain technology is enabling the development of decentralized finance (DeFi) applications, which allow for peer-to-peer financial transactions without the need for traditional financial institutions. This can lead to reduced fees, increased access to financial services, and greater financial inclusion for those who are underbanked or unbanked.

Supply Chain Management: Blockchain technology can improve the transparency and efficiency of supply chains by creating a secure and transparent ledger of transactions. This can help to reduce fraud, increase transparency, and improve product traceability, which can ultimately benefit consumers.

Voting Systems: Blockchain technology can improve the security and transparency of voting systems, making it harder for fraudsters to manipulate the results. This can lead to more accurate and trustworthy election results, which can ultimately benefit society as a whole.

Intellectual Property Protection: Blockchain technology can provide a secure and tamper-proof way to protect intellectual property rights. This can benefit artists, writers, musicians, and other creators who rely on their intellectual property for their livelihood.

Charity Donations: Blockchain technology can provide greater transparency and accountability in charitable donations, making it easier for donors to see where their money is going and how it is being used.

In conclusion, blockchain technology has the potential to benefit the average person by providing secure, transparent, and decentralized solutions to long-standing problems. As blockchain technology continues to evolve and become more widely adopted, we can expect to see even more applications that will benefit individuals and society as a whole.

The traditional banking system has been around for centuries, but it is not without its flaws. The system is often slow, expensive, and lacks transparency, leading to inefficiencies and distrust among consumers. However, blockchain technology has the potential to revolutionize the way we bank by addressing these issues and providing a secure and transparent way to conduct transactions.

At its core, blockchain technology is a decentralized, digital ledger that records transactions securely and transparently. Each block in the chain contains a unique cryptographic hash, linking it to the previous block, creating a continuous chain of blocks. This makes it nearly impossible to tamper with the information in the blockchain, providing an unparalleled level of security and transparency.

One of the biggest advantages of blockchain technology is its ability to streamline the banking process. Traditional banking systems require multiple intermediaries to facilitate transactions, leading to high fees and long processing times. Blockchain technology, on the other hand, allows for direct peer-to-peer transactions, eliminating the need for intermediaries and reducing transaction costs and processing times.

Furthermore, blockchain technology allows for real-time settlement of transactions, which means that transactions can be completed instantly, rather than taking days or even weeks as is often the case with traditional banking systems. This not only benefits consumers, but it also benefits businesses that rely on timely payments to operate effectively.

Another advantage of blockchain technology is its ability to enhance transparency and accountability. Blockchain technology allows for complete transparency of transactions, which means that anyone with access to the blockchain can see all transactions that have taken place. This enhances accountability, as all parties involved in the transaction can be held responsible for their actions.

Blockchain technology can also help to prevent fraud and money laundering. The transparency of blockchain technology makes it difficult for fraudsters to conduct illegal activities, as all transactions are recorded and can be traced back to the parties involved.

Blockchain technology is already being used by some banks to improve their processes. For example, Barclays and HSBC have both used blockchain technology to conduct successful trades, and Santander has launched a blockchain-based payment app for international transfers.

In conclusion, blockchain technology has the potential to revolutionize the way we bank by addressing the issues of transparency, security, and inefficiency that are present in traditional banking systems. As blockchain technology continues to evolve, we can expect to see more banks adopting it to improve their processes and provide a better service to their customers. The future of banking is blockchain, and we are excited to see where this technology takes us.

Blockchain technology has rapidly emerged as a revolutionary technology, offering new and innovative ways to conduct transactions, streamline processes, and enhance transparency and security. Its applications span across various sectors and industries, including finance, healthcare, logistics, and supply chain management. Blockchain technology has also become an increasingly popular topic in higher education institutes across Europe, with many institutions recognizing its potential to transform various aspects of society and business.

The primary concept behind blockchain technology is that it allows for the creation of a secure, transparent, and decentralized ledger of transactions. Each block in the blockchain contains a unique cryptographic hash, which links it to the previous block, creating a continuous chain of blocks. This makes it extremely difficult for any party to manipulate the information contained in the blockchain, providing an unparalleled level of transparency and security.

Higher education institutes across Europe have recognized the potential of blockchain technology and are now incorporating its teachings into their curricula. Many universities offer courses that focus on blockchain technology, its applications, and its impact on various industries. For example, the University of Nicosia in Cyprus has launched a Master's program in Digital Currency, which covers topics such as blockchain technology, cryptocurrency, and decentralized applications. The program is the first of its kind and has received a lot of attention from students and professionals alike.

Other universities in Europe have also introduced courses and modules that cover blockchain technology. The University of Cambridge in the UK has launched a course on Fintech, which includes topics such as blockchain and distributed ledger technology. Similarly, the University of Luxembourg offers a course on Blockchain and Distributed Ledger Technology, which covers the fundamentals of blockchain technology, smart contracts, and decentralized applications.

The incorporation of blockchain technology into higher education curricula has many benefits. Firstly, it provides students with an opportunity to learn about emerging technologies and the potential applications of these technologies in various industries. This knowledge can be leveraged by students to develop new ideas and business models that can transform industries and create new opportunities.

Secondly, the teaching of blockchain technology in higher education institutes can help bridge the skills gap that currently exists in the blockchain industry. As blockchain technology is relatively new, there is a shortage of skilled professionals in the field. By teaching blockchain technology in higher education, universities can equip students with the skills and knowledge required to enter the blockchain industry and drive innovation.

Lastly, the incorporation of blockchain technology into higher education curricula can help universities to establish themselves as leaders in emerging technologies. By offering courses and modules on blockchain technology, universities can attract students and researchers who are interested in this field, helping to build a community of experts who can contribute to the development of the technology.

In conclusion, the incorporation of blockchain technology into higher education curricula is a positive step towards driving innovation and transformation in various industries. By teaching blockchain technology, universities can provide students with an opportunity to learn about emerging technologies, bridge the skills gap in the blockchain industry, and establish themselves as leaders in the field. As the blockchain industry continues to evolve, the demand for skilled professionals will increase, making it critical for higher education institutes to offer courses and modules on this technology.

I will explain to you how a blockchain works. You will also understand what problems it solves. However there is no such thing as the one blockchain, but there are countless of them with different characteristics.

Simply explained, the blockchain is nothing more than a database. And a rather inconvenient, slow and inefficient database at that. So why is blockchain technology needed? Because it is also a tamper-proof database!

The blockchain is an database

You already know databases from countless applications. They do nothing more than store large amounts of data without contradiction and permanently and make it accessible again. In traditional databases, documents, image files, account balances and much more are stored digitally. The data is stored on physical storage, sometimes redundantly with backups. The data is therefore stored in only one or two locations. Whoever has sovereignty over the database storage can set access rights and can also modify the data.

The blockchain is a decentralized database. It consists of many computers that participate in the blockchain network. They are all connected to each other via the Internet. The exact same information is stored on all participating computers. So, unlike traditional databases, the data on the blockchain is stored not just once, but multiple times: exactly as many times as computers participate in the network.

The Bitcoin-blockchain explained

Further on, I will explain the concept using the Bitcoin blockchain as an example: on it, everything is all about the Bitcoin coins. The network verifies every transaction between sender and receiver. It checks whether the coin sent was really spent only once, or whether the sender wanted to cheat. The transaction is stored "on the blockchain" after positive verification.

For a detailed understanding of how the Bitcoin blockchain works, let's look at the two terms: Block and Chain.

The term Block

A transaction is every process in which Bitcoin coins change hands or Bitcoin coins are created. Each transaction is sent to all computers that participate in the Bitcoin blockchain. Each computer collects all incoming information together until a so-called block has been filled. Once the block is filled, all computers on the network simultaneously begin solving a complicated mathematical puzzle. The solution requires high computational effort, which is only feasible by special computer components using high amounts of energy.

The solution to the puzzle generates the cryptographic key for this block, which seals the transactions in the block. This is because the key depends on the transactions stored in the block: any change in the transactions requires a recalculation of the key.

The first computer to find the solution adds the cryptographic key to the block and sends the entire newly created block to all participants in the network. The winner gets paid a reward in newly created bitcoin coins for its resource input (the process is called mining), the other participants go away empty-handed.

The term Chain

The blockchain chain consists of blocks strung together one after the other. The subsequent immutability of all blocks is ensured by inserting the cryptographic key of the previous block into the respective new block. Thus, a chain of blocks encrypted into each other is formed. The chain becomes longer and longer, only one new block is added at a time, and no block can be removed.

Thus, if a fraudster wanted to change a previous transaction in an old block, he would have to recalculate the key of the old block and all others up to the current block, and additionally change the copy on the majority of participating computers. Abuse is prevented because this high effort is economically unattractive.

The properties of other blockchains

The main properties of a blockchain are:

Other blockchains differ from the Bitcoin blockchain described above primarily in the characteristics of speed, security and decentralization. This is because an optimum must be found between these three characteristics.

Let's dive into a completely new world: that world of blockchain technology, cryptocurrencies, tokens, Web3 and decentralized finance.

I will open up a new world to you: a decentralized world where all financial transactions are possible without banks and central instances. A world that, thanks to decentralized databases and cryptographic keys, will in a few years change the way we use the Internet, change our value chains, and change how politics and society interact.

Bitcoin is the key to the blockchain world

To open this new world, let's go back to the year 2008. Only a few weeks after the peak of the financial crisis with the collapse of the American bank Lehman Brothers, a scientific article by a previously (and to this day) unknown person appears: Satoshi Nakamoto writes the white paper "Bitcoin: A Peer-to-Peer Electronic Cash System" and thus not only establishes blockchain technology as a decentralized database system, but also Bitcoin as the first of many cryptocurrencies to come. Through this paper, the blockchain is inextricably linked to the cryptocurrency Bitcoin.

What were Satoshi's reasons for thinking about a decentralized payment system in the first place? Since you can't pay cash in Internet commerce, and thus withdraw payments even after the service has been delivered, buyers and sellers must trust each other. This trust must be established either through third parties or by asking for personal data. Trust thus comes at a cost: involving third parties costs money, the inevitable acceptance of fraud costs money, the disclosure of personal data costs privacy.

Cryptography replaces trust

Satoshi proposes to replace mutual trust in financial transactions with cryptography, making the third party in payments obsolete. Cryptography is a technology to encrypt information so that only the intended recipient can read the transmitted message. A distributed decentralized computer network provides proof of the chronological order of transactions, confirming that a coin has not been spent twice. Reversing cryptographically secured transactions in a decentralized computer network is computationally only possible at a very high cost of computing capacity.

Cryptography thus replaces the trust we have previously placed in our currencies and our government institutions. By trusting the program code of the blockchain, we also trust the privateinstitutions that create this new money.

What are cryptocurrencies?

Today, a large number of different projects are gathered under the term cryptocurrencies, all of which have in common not to exist physically, but to store the transactions of their "coins" cryptographically on a decentralized database. They are tradable on crypto exchanges, but very few of them are designed to be used only as a means of payment. Many bring additional benefits, such as voting rights in their network, or they serve as currency for their network's transaction fees, or they even replicate real-world assets.

So far, cryptocurrencies are issued by private projects. In most of them, anyone can participate in the production of the coins (the process is called mining) by downloading the software and providing computing capacity for the decentralized network. The miner is rewarded for his efforts through payments in cryptocurrency.

In contrast, some central banks are also looking into using blockchain technology for their currencies. This digital central bank money would replace or augment cash. For me, however, digital central bank money does not qualify as a cryptocurrency, because the most important criterion, decentralization, is obviously not given with central bank money.

The author's name is Enza Cirone and her LinkedIn can be found here: https://www.linkedin.com/in/enza-cirone-2625b0167/

A first introduction

We are at the gates of an epochal and structural change to the dynamics of society. This innovation is brought about by the so-called Self-sovereign identity (SSI) which offers a new point of view to users who can manage and be in control of their digital identities.

Why “self-sovereign”?

This concept represents the idea of a person’s identity that is neither dependent on nor subjected to any other power or state.

How far back does this concept go?

When Satoshi Nakamoto first published Bitcoin: A Peer-to-Peer Electronic Cash System in October 2008, no one expected it could also inspire a fundamental transformation in the idea of identity and trust.

Yet, the relationship between money and identity has been already explored by many experts such as David Birch, the author of Identity is the new money who in 2014 analysed how identity and money were profoundly and equally changing. Additionally, in the 2015 Internet Identity Workshop, several sessions were held on “blockchain identity”.

That event opened the discussion on the potential applicability of Blockchain to create a distributed and scalable system for identity management.

But what is the role of decentralization?

The evolution of internet identity models can provide a thorough explanation.

Three Models for Digital Identities: centralized, federated and decentralized

The centralized model is the easiest to explain because is the original form of digital identity, as well as the one that, in many cases, we still use today. In this model, all identifiers and credentials (e.g., passports, ID cards, social media handles) are issued by central authorities or service providers. It is also called the account-based identity model.

So, one might ask what the problem is with this model, considering thatwe are still using it today and that this should imply that it is all right. Not exactly. The user’s identity exists as long as the corresponding account resides in some centralized system. Users do not have control over their identity.

Besides, as a customer, users have to remember several credentials, one for each app or service. This can easily lead to forgetting or reusing passwords, causing security loopholes.

With the federated identity model, a third-party company or consortium (identity provider)is added between the user and the central authority.

Why do we call it “federated”? Because the identity provider only gives the user one identity account with which they can accede any site or app that uses that IDP.

This model has also assumed the connotations of a user-centric model within the consumer environment. A common example of this model is “social login” on the Web using a social media account (e.g., Facebook, Twitter, Google) to access a third-party service.

One of the downsides of the IDP model is that there is not one identity provider that works with the sites, services, and apps. Therefore, users need accounts with multiple IDPs, that is multiple digital identities for each service they interact with. Practically, that means users will end up forgetting which IDP they used with which site.

Could the downsides of the previous two models described be mitigated by the self-sovereign identity model?

The answer is yes. In this model, there is no central authority needed to allow the system to work. Conversely, identity and its related claims (i.e., anything «linkable» to an identity, such as a diploma) are given back to the user.

This system works like identity in the real world, as it is based on a direct relationship between a user and another party as peers. This means that any peer can connect to any other peer anywhere.

And how does Blockchain technology allow this model to work as an identity layer?

It is possible by leveraging the key characteristics of Blockchain, that is decentralization, immutability and transparency. Blockchain is indeed a shared ledger which uses a consensus mechanism to achieve trust and maintain security across the underlying decentralized protocol.

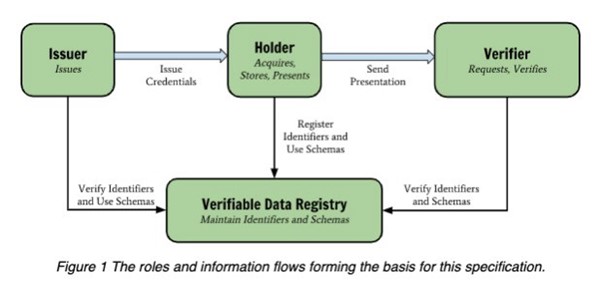

Self-sovereign identity is a set of technologies that build on core concepts in identity management (decentralized identifiers and verifiable credentials), cryptography (public/private key) and blockchain.

What about the underlying technology of the SSI model?

Blockchain technology, Decentralized Identifiers (DIDs) and Verifiable Credentials (VCs) are the three pillars of Self-Sovereign Identity.[1]

Let’s see them in further detail.

First, the SSI model is based on the use of Decentralized Identifiers (DIDs) that are fully under the control of the DID subject, independent from any centralized registry, identity provider, or certificate authority. They allow for the creation of unique, private and secure peer-to-peer connections between two parties.

“DIDs are a new type of identifier that enables verifiable, decentralized digital identity. A DID refers to any subject (e.g., a person, organization, thing, data model, abstract entity, etc.) as determined by the controller of the DID.”[2]

Second, as conceptualized and standardized by the W3C, the Verifiable Credentials Protocol is another necessary backbone of the SSI system. “Verifiable credentials represent statements made by an issuer in a tamper-evident and privacy-respecting manner.” [3]

By using verifiable credentials, entities act as central actors controlling everything related to their identity in a “digital wallet” (similar to a physical wallet) that contains verifiable claims (e.g., diplomas, passports). These verifiable credentials are digitally signed and can cryptographically prove:

1. Who (or what) is the issuer;

2. To whom (or what) it was issued;

3. Whether it has been altered since it was issued;

4. Whether it has been revoked by the issuer.[4]

Essentially, VCs are:

- standardized, VCs follow the W3C Verifiable Credentials standard so they can be used and recognized worldwide;

- tamper-proof, as they are cryptographically signed by trusted authorities;

- sovereign, as they allow users to have control of their identities;

- portable, as users are not limited to using the VC within the issuer’s ecosystem (for ex. a national ID within e-government services);

With Verifiable Credentials, credential holders (i.e., each of us!) can manage and share their identity credentials stored in the digital wallet and use them to immediately prove their identity and access digital or in-person services.

Likewise, organizations (i.e., universities, banks, etc) can automatically verify user identities to prove their legal validity.

And right there the blockchain infrastructure plays a leading role. The verifying parties do not need to check the validity of the actual data in the provided proof but can rather use the blockchain to check the validity of the attestation and attesting party (such as the government) from which they can determine whether to validate the proof.

Conclusion

The purpose of this article was to shed light on the SSI model, highlighting its pros in comparison to other identity management models. SSI is indeed rooted in the belief that individuals have the right to an identity independent of reliance on a third-party identity provider (e.g., the state or any other central authority).

Furthermore, this analysis aimed to show that, like most other technologies, SSI stands on the shoulders of giants. Yet, even though the self-sovereign model has been tied to the use of blockchain and has been implemented as blockchain adjacent, it is not a blockchain-dependent identity management system; conversely, this system is guided by the fundamental principle of user-centric design and based on technical standards.

I am aware that, when it comes to analysing the benefits of the SSI, other competing social interests like user privacy, security and law enforcement should be taken into account. However, my intention was not to conduct a thorough and comprehensive analysis of the subject, on the contrary, I briefly introduced this new model to leave the discussion of its (legal) implications to another article.

This is not the end, indeed the journey towards a decentralised identity system has just begun. And the best is yet to come.

********

Thanks to the DLT Talent program (DLTT), an 18-week mentoring program to empower young female talent for leadership in the blockchain space. More information about this program can be found here: http://www.dltt.io.

********

[1] Verifiable Credentials Data Model v1.1 — Expressing verifiable information on the Web https://www.w3.org/TR/vc-data-model/.

[2] https://medium.com/evernym/the-three-models-of-digital-identity-relationships-ca0727cb5186.

[3] The foundation concepts of SSI were officially brought to life when the Credentials Community Group was created under the international organization World Wide Web Consortium (W3C) which generates standards and recommendations for the Internet.

[4] Decentralized Identifier Resolution (DID Resolution) v0.2 — Resolution of Decentralized identifiers (DIDs), Draft Community Group Report 02 February 2022, https://w3c.github.io/did-core/.

The ban of Tornado Cash, a crypto mixer service, shocked the crypto community. Developers of the project are internationally searched and being prosecuted. This happening underlines the war against privacy and the skepticism of governments towards autonomous individuals. The new technologies; the internet, decentralized ledger technologies and decentralized autonomous organizations are being portrayed as dangerous for society. However, these technologies actually brought new forms of individual autonomy. They secure human rights such as freedom of contract and speech as well as privacy. Author: Julian A. Proft

On August 8., the U.S. Department of the treasury announced their ban of the digital currency mixer service Tornado Cash with the claim that “Despite public assurances otherwise, Tornado Cash has repeatedly failed to impose effective controls designed to stop it from laundering funds for malicious cyber actors on a regular basis and without basic measures to address its risks. Treasury will continue to aggressively pursue actions against mixers that launder virtual currency for criminals and those who assist them.” (U.S. Department of the Treasury press release). Tornado Cash is an Ethereum-based service that offers to anonymize crypto transactions. This press release calling users of digital privacy services criminals, opened up a discussion about privacy, free-speech and about the seemingly increasing fight of governments against autonomous individuals. This article explores some political implications of the Tornado Cash ban and why privacy is a necessary aspect of the democratic society. Author - Julian A. Proft

The legacy of crypto assets started with Bitcoin in 2008. Satoshi Nakamoto envisioned a world free of external coercion to free individuals operating in peer-to-peer systems, financial freedom, freedom of speech and thought and freedom of contract so individuals benefit from the value which they created. Bitcoin is a new form of digital money where trust in the network is established through healthy competition and the proof-of-work mechanism. This system would enable full financial inclusion and new forms of financial systems and taxation.

Fourteen years later, this vision became an utopia - a state of the world far from reality. Why has this new system not been adopted yet, if it works so great?

Certainly, Satoshi Nakamoto created an outstanding asset with the aim to solve all of our socio-political problems. Bitcoin was the starting point of the movement, but it’s not perfect. Bitcoin is pseudonymous but not private. The use of Bitcoin creates an abundance of data that can be collected and analyzed as we have seen with the emergence of Chainanalysis and Dust attacks. The lack of privacy in the network turned out to be a challenge that hindered broad adoption and opened doors for censorship. The common on-ramp to cryptoassets are still centralized exchanges that can be regulated (see MICA), and thus in the future potentially turned into bank-like institutions.

Emerging technologies bear as many risks as benefits. All the benefits that the Bitcoin network offers could also be turned around and be used against the network’s users. In 2018, the Office of the High Commissioner for Human Rights issued the Report on the right to privacy in the digital agewhere they highlight the importance of privacy.

Yes, according to Article 12 of the Universal Declaration of Human Rights (UDHR) privacy is a human right!

The report identified that despite the great benefits of data-driven technologies, there are also huge risks involved, such as “both States and business enterprises are able to conduct surveillance, analyse, predict and even manipulate people’s behavior to an unprecedented degree.” So, it seems like tracking and storing people's data even on greater scales seems fine but protecting oneself from the risks of being surveilled is a crime? This is at least true for the suspected developers of Tornado Cash. One of them was arrested in Amsterdam and is investigated on the matter on suspicions of asset confiscation, environmental crime and fraud.

The implication of privacy exists in many instances in individual lives, like the meal that I choose for breakfast. So, why does the world not need to know about my food choices? - Because it does not interfere with anybody else's freedom. The moral principle behind this premise is called Negative Freedomand was developed by Isaiah Berlin. Negative Freedom is a concept of freedom, where one is free in his actions as long as they do not interfere with the freedom of others. Additionally, Negative Freedom is universalizable, which means and works great for the understanding of privacy. A private matter would be thereof any information that does not interfere with the rights of others.

Generally, based on freedom of contract, an individual is free to do with their money as they wish. If I choose to pay 10€ for a scoop of ice cream, and the other party accepts my offer of 10€, we both create a win-win situation, because we both get what we want. Our deal does not interfere with other individuals. Thus, other parties have no obligation to know about it. Instances like the ice cream deal are the usual social-economic situation that should not be interfered with. The same is true in DeFi (decentralized finance). Using DeFi does not pose any immediate threat to society and therefore demanding full transparency is not in balance with the risks involved.

Privacy of transactions was never a huge problem in times of cash because everybody could trade “peer-to-peer” in the analogous world without the need to on-ramp money to a bank account and the BaFin checking those transactions. However, times have changed through the emergence of new technology like Bitcoin and smart contracts. Bitcoin is transparent which is critical for the network. We have to change our perception of privacy in the metaverse, the web, and any digital environments, where data can be collected, stored, and analyzed. Privacy is valuable because data is valuable. But we often choose to throw our own privacy out of the window for added comfort.

Privacy is a human right, which means that the default of every transaction that an individual performs should be private. It is unbelievable that the human right of privacy gets pushed away because of governmental claims of anti-money laundering and financing of terrorism. There is no immediate threat for society that arises through the use of DeFi. Governments have to find another way to regulate DeFi instead of outright declaring war on privacy and banning services with claims of money laundering and financing of terrorism.

Financial freedom is arguably one main pillar that secures individual freedom. In a digital society where states freeze crowdfunding campaigns, the worst case in the future would be a system where every transaction is analyzed and confirmed by the state. Similarly, to the situation at the airport, where travelers have to show their belongings to prove their innocence before boarding an airplane. A complete financial overwatch would mean financial totalitarianism and the end for any individual freedom that is left. So, CBDCs (Central Bank Digital Currency) pose a threat to privacy, because they are issued by central banks which could analyze and interact with the blockchain themselves.

Fortunately, the ban of Tornado Cash is certainly not the end for privacy in the Metaverse. Digital services and cryptoassets like Monero, Zcash, Dark.fi, I2P and peer-to-peer exchanges still form the backbone of privacy services.

Economic transactions always entail some sort of expression. By choosing one service over another, individuals signal their preferences and thus support the cause. We have to actively deploy and use services that support individual privacy to make them widely adopted.

If individual autonomy has to be secured, then we also have to act on it. We cannot expect businesses and governments to beneficially provide our rights when they have reasons to not do so. Collected data is being sold to other businesses as well as governments and such governments use that data to secure control over society. It is alarming that privacy service providers are being called criminals in the first place. Especially if these services are promoting article 12 of the Universal Declaration of Human Rights (UDHR) and help society to minimize the exposure to data collection and analytics with their work.

Herewith, I authorize Generation Blockchain to post this article on social media and further publish it on the Generation Blockchain Website.

By Catalina Buitrago B.

@Catalina_BB

The “Build” Market Community

Recently, we all have experienced the intense hug of a bear market. The entire economic system is being challenged by the devastating effects of a pandemic and at the same time reinventing itself to face the challenges of a post-pandemic era. All the current situations that we are experiencing, are just a confirmation on how interconnected we are, and how we can all benefit or be affected by scattered and/or massive world events. All of this led me to asking: instead of surviving in a bear or a bull market, why don’t we thrive in creating a build market?

When I first heard about this concept in a Podcast, it really opened my mind to a wide range of possibilities and many ideas came to the surface, however, one really resonated within and inspired me to write this article. Since I started immersing in the Blockchain ecosystem, thanks to the network created by the Frankfurt School of Finance and Management’s Blockchain center, I’ve been nourishing myself with information on how it works, the infinite possibilities that exist to materialize any project that one can imagine, while simultaneously, meeting unbelievably smart and kind human beings coming from a large variety of backgrounds building a great worldwide community.

Health and Wellness built in Blockchain

After working for more than ten years in the banking sector, I came to appreciate how valuable health and wellness are; they both play a core role in our performance in almost every task to which we commit, whether it be in our working or our personal environment. Thanks to this awakening, I realized how impactful the support of a community is. This support is necessary if we are to be successful in planting the seeds to accomplishing our goals, understanding different subjects (education), acquiring healthy habits and being part of a network of people who shares common values and interests with us whilst being rewarded for it. The Blockchain ecosystem is the underlying technology that is allowing all those seeds to be planted, whose fruits will be gathered in hopefully a decade or less.

We all have heard of Blockchain’s dark side: how cryptocurrencies are being used in the black market or how scammers and hackers have managed to destroy the reputation of this technology, yet it has still managed to survive and succeed. There is, however, more to blockchain, as I am sure many experts and enthusiasts will agree.

About a month ago, I came across an article about “Incentivizing Healthy Behaviors With Blockchain Technology” published by Nasdaq and I started to do research on the subject. It completely blew my mind that a software company called Mosio launched an app that runs in the Ethereum blockchain named Clinicoin. It is based on a proof of engagement system, where users participate to earn coins, with the purpose of providing a secure channel that allows communication between the health and wellness industry providers, developers and users in an effort to improve global health and wellness.

The Wellness industry is worth more than $3.7 trillion worldwide, here final users, the ones who pay for the services, probably are not being rewarded for creating the majority of value of a very wealthy industry, one might wonder how all the actors in this story benefit. I could not picture another option better than Blockchain to recognize the real value users add to companies. Thanks to the tokens and smart contracts created under this technology, the proof of engagement models are possible. In this case, for the health and wellness industry, value is found in different sources. Statistics for example, are vital to conducting research on new treatments, new medicines, new biohacking technologies, among others. Interesting to note that we, the patients, the users, are the providers of such information. We, as individuals, carry all sorts of valuable data that is important for the evolution of our kind, for us to be healthier, for us to heal ourselves and for multiplying the effect on others, and we should be rewarded for that, not necessarily only in currency, but with other intangible benefits as well.

The Role of AI and Measurement Devices

This year in May, The Economist published in its Technology Quarterly issue “The Quantified self” compiling a series of articles on AI, wearable devices and apps from where data is being utilized as a source for a sizable amount of medical research. Regardless the developer’s brand, academics analyze data from any tracker which measures heart rate, physical activity or sleep activity and are able to predict future infections and possible illnesses with disease-surveillance algorithms. Although I found this fascinating, it is important to be aware that to conduct these types of research, individuals need to sign up or download the apps and grant permission to share their data for research studies. Sadly, not many are willing to do so, or if they are initially willing, they drop out before the study finishes. Here is where the Blockchain proof of engagement models and tokens are of significant importance.

Clinicoin app is one of the pioneers utilizing blockchain technology and has a very well structured model that includes the core parts in the supply chain of the Health and Wellness industry. They have created their own tokens, CLIN, to use as means of reward within their space.

I have no affiliation to or with Clinicoin in any sense, however, for me it was the best use case so far to develop my thesis. Health is one of, if not the most, valuable assets of human kind. Hence, we must preserve it and develop technologies and medicines that allow us to heal, we need to battle against all sorts of illnesses, viruses and bacteria and to stay healthy as well. At the same time, through this healing process we must find sustainable ways of reaching a wellness state that also protect our home: The planet earth.

A Space to Be Creative

Finally, how are you going to build in this market? I invite you to be part of projects, ideas, companies such as Clinicoin to reach a critical mass of users in order to succeed. The topic for me was health and wellness, but it could be different for you. What is your passion, purpose? In what are you an expert? What motivates you? Climate change? Education? Payments? Engineering? Robotics? AI? Financial Access? Investment? Gaming? Any other? How will the participation be set up? Play-to-earn, learn-to-earn, meditate-to-earn, innovate-to-earn? Blockchain offers endless options to build, you just have to be curious, creative and eager to learn.

By S.Anusuyadevii

Micro finance is providing financial services such as micro loans, collection of thrift, pension,

insurance etc. Micro loans are provided to the marginalized segment to finance new business,

paying urgent family needs etc., without any collateral and the repayment is done based on the

income generated from the business done by the borrower and periodicity of loan repayment can

be weekly, fortnightly etc. As per World Bank data, close to 1.7 billion people across multiple

countries do not have access to basic financial services1. Hence, MFIs play a major role.

In India, Micro finance activities are being carried out by scheduled commercial banks, small

finance banks, Urban co-operative banks, Regional Rural Banks, NBFC-MFIs and other MFIs (not

for profit organizations).

Microfinance has grown in size, outreach and financial growth over the past two decades.

The outstanding loan portfolio of Micro Finance sector as on March 31, 2021 is Rs. 2.59 lakh

crore excluding Self-help Group linked Bank lending. The share of the players are as follows:

scheduled commercial banks (43.67%), small finance banks (15.87%), NBFC-MFIs (31.05%),

NBFCs (8.35%) and others (1.04%) and the average loan size for the year 2020-21 is Rs. 34,641/-.

The objective of the article is to discuss sources of funding available for the NBFC-MFIs,

difficulties faced in securing these funds and exploring whether blockchain technology can

used as a facilitator for securing funding by MFIs. The scope can be extended to other

microfinancing arms such as Section 25 companies who may not have access to funding with

ease.

NBFC-MFI is a non-deposit taking NBFC with minimum net owned fund of ₹5 crore (₹2 crore for

NBFC-MFIs registered in the North Eastern Region) and having minimum 85 per cent of its net

assets (assets other than cash, bank balances and money market instruments) in the nature of

‘qualifying assets’.4 The average credit dispensed to an individual borrower NBFC-MFI is

approximately Rs.34,125/-

The role of MFIs is to lend small ticket loans to borrowers from the marginalized sections who

otherwise do not have a chance to be part of traditional banking channel. To lend money to its

borrowers, MFIs need access to funding. Since they are non-deposit taking NBFCs, they cannot

accept deposits from public which thereafter can be used for onlending. Therefore, the sources

of funding, broadly, include own capital, loans from banks, funding by big NBFCs, raising fund

through securitization of their loan portfolio, funding from bilateral or multilateral organizations,

private investors, subsidies and grants, External commercial borrowings etc.,

1. https://www.bankbazaar.com/personal-loan/microfinance-institutions.html

2. NBFC-MFI definition – Page No 9- RBI- CONSULTATIVE DOCUMENT ON REGULATION OF MICROFINANCE dated Jun 14, 2021

3. Page 7 -Micrometer data as on March 31, 2021

One of the funding avenue available for MFIs is from Banks. Banks can fund MFIs to meet their

priority sector targets. Priority sector norms are applicable to every Commercial Bank [including

Regional Rural Bank (RRB), Small Finance Bank (SFB), Local Area Bank] and Primary (Urban)

Co-operative Bank (UCB) other than Salary Earners’ Bank licensed to operate in India by the

Reserve Bank of India. As on date, Priority sector lending norms for Commercial Banks, Urban

Co-operative Banks and Foreign banks 40 per cent of ANBC or CEOBE whichever is higher as

applicable as on the corresponding date of the preceding year. For RRBs and Small Finance

Banks, it is 75 per cent of ANBC or CEOBE whichever is higher as applicable as on the

corresponding date of the preceding year.

Priority sector lending norms require scheduled commercial banks to allocate 40% of the total net

bank credit as on 31st March to priority sector advances which includes 10% of the priority sector

advances or 10% of the total net bank credit, whichever is higher going to weaker section. These

targets can be met by methods such as lending by the banks themselves to priority sectors,

extending credit to registered NBFC-MFIs and other MFIs (Societies, Trusts etc.) which are

members of RBI recognised SRO for the sector, for on-lending to individuals and also to members

of SHGs / JLGs on-lending to individuals under respective priority sector categories. Banks can also purchase Priority Sector Lending Certificates (PSLCs) from other banks to achieve the

priority sector lending target and sub-targets in the event of shortfall or by investments in

securitized assets originated by MFIs or assignment /outright purchase of eligible priority sector

loans from MFIs.

4. NBFC-MFI definition – Page No 9- RBI- CONSULTATIVE DOCUMENT ON REGULATION OF MICROFINANCE dated Jun 14, 2021

5. Page 29 -Micrometer data as on March 31, 2021

6. 40 per cent of ANBC or CEOBE, whichever is higher (as on March 31, 2020), which shall stand increased to 75 per cent of ANBC or CEOBE,

whichever is higher, with effect from March 31, 2024

7. Master Directions- Reserve Bank of India (Priority Sector Lending – Targets and Classification) Directions, 2020

As per Micrometer data as on March 31, 2021, among the funding instruments used by NBFC

MFIs, term loans contributed 70.80% of the debt outstanding, followed by debentures at 20.7%,

sub-debt at 4.1%, commercial papers at 0.4% and other instruments 4.0% and smaller entities

appear to rely on term loan for smaller entities. As the size of institution increases, diverse option

of funding become available to these institutions.

Micrometer data for the year FY 20-21 states that during FY20-21, NBFC- MFIs (based on a

sample of 52 NBFC MFIs) received a total of Rs 40,797 Cr in debt funding from Banks and other

Financial Institutions. 67% of debt funding for Large MFIs was from Banks. Medium MFIs were

able to source 32% of their funding from banks and remaining (68%) from other FIs. Small MFIs

received 24% of their debt funding from Banks.

As per Micrometer data for the year FY 20-21, out of the borrowings received during FY20-21 by

54 NBFC MFIs, Other Banks contributed to 46.9% of the borrowings followed by 20.4% from non-Bank entities, 18.5% from top 5 banks, and 13% from AIFIs , 0.9% from ECB and 0.4% from

Others. However, for Small MFIs no borrowing was received from AIFIs and top 5 banks.

To access the capital market such as debt funds, Small and mid-sized NBFCs need to get desired

level of credit rating. FIDC in its letter stated the following with respect to accessibility of capital

marker by NBFC MFIs : Given the size of these NBFCs, their credit rating makes them ineligible

for funding. “All the credit rating agencies use the same scale to rate both large and small NBFCs.

In such a scenario, it is practically impossible for a small sized NBFC to get the desired level of

credit rating despite a sound balance sheet and excellent track record. Sometime banks have

been risk averse in lending to NBFCs, except for the large NBFCs which have a good parentage

and are of a certain size…Further, banks may not lend once their sectoral exposure caps is met.

Though mutual fund and insurance companies can lend to NBFC sector, due to risk aversion they

may also not lend when needed.

One of the reasons for inability to access funds by small and medium NBFC MFIs is risk aversion

on the part of lenders such as banks, mutual funds and insurance companies etc., The reason

could be lack of access to loan portfolio data that can be verified so as to make proper credit

assessment by the lenders. In this article, we will explore whether this issue can be addressed

using blockchain. Before we dwell onto how block chain can be utilized for the extant problem, an

introduction of block chain may be of order.

8. Business Standard July 17, 2020

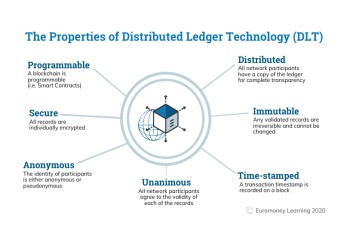

Block chain: Blockchain is a system of recording information in a way that makes it difficult or

impossible to change, hack, or cheat the system. A blockchain is essentially a digital ledger of

transactions that is duplicated and distributed across the entire network of computer systems on

the blockchain. Each block in the chain contains a number of transactions, and every time a new

transaction occurs on the blockchain, a record of that transaction is added to every participant’s

ledger. The decentralised database managed by multiple participants is known as Distributed

Ledger Technology (DLT).

The cryptographic protocols along with consensus algorithm makes sure that the network is safe

and all the data is good. Blockchain’s immutability feature ensures that no data is changeable

once it is written. Other key features of blockchain technology include transparency and trust.

A diagram of block chain is given below:

9. Euromoney learning

Evolution of blockchain technology enabled Block chain technology to be leveraged by the

enterprises leading to permissioned block chain. Multichain, Ripple, R3 Corda , Hyperledger etc.,

are the permissioned blockchain solutions to meet the needs of enterprises where privacy of data

is important whereas in public blockchain, the data is not private.

The permissionless or public blockchains require no permission to join or interact with it. Bitcoin,

Ethereum etc. are public chain. Users can create a personal address and then interact with the

network by either helping the network to validate transactions or simply send transactions to

another user on the network. The trust is that the state of transaction is immutable and this is

maintained through mining native currency to reward the miners who add the block or to pay by

those who want their transactions to be added to the network. The characteristics of the block

chain are pseudo anonymity, time-stamped, immutable, distributed, secure and unanimous as it

is based on consensus protocol incorporated in the blockchain.

Permissionless blockchains may not be of a solution for enterprise use cases where data privacy

is an important factor. Hence, the need for permissioned block chain arises where though the

underlying technology of blockchain is used, access to the network is based on the permission

given.

Permissioned blockchains, on the other hand, operate a blockchain amongst a set of known,

identified and often vetted participants operating under a governance model that yields a

certain degree of trust. A permissioned blockchain provides a way to secure the interactions

among a group of entities that have a common goal but which may not fully trust each other.

The problem of small and medium NBFC -MFIs is difficulty in accessing funds from mutual funds

or insurance companies and also from banks who have enabling regulatory provision to lend it

to them either in the form of loans or for onlending to priority sector or through purchase of

securitized assets of underlying good priority sector loans. Lenders are wary of lending to small

and medium MFIs as they do not have full visibility to the quality of these MFIS portfolio. Small

and Medium MFIs are unable to tap the capital market as they are not in a position to get

investment grade rating from the rating agencies.

In this context, it may be mentioned that as per para 100 of Master Directions of Non Financial

companies issued by RBI10, NBFCs having customer interface have to become member of all four

Credit information companies who maintain a separate MFI bureau to capture credit history of

borrowers of NBFC-MFIs.

Since the MFIS need to maintain and update the credit information of all its customers on monthly

basis, we may explore whether this data can be leveraged to seek fund from banks or other

lenders using Permissioned block chain. It may be mentioned that RBI has accorded SRO status

to two entities, namely,, MFIN and Sa-DHan. Though role of Self-Regulated organization is to

support member NBFC-MFIs in adhering to regulatory and industry standards, with focus on

customer welfare and protection, we may explore whether role can be leveraged to onboard the

MFI data in the permissioned block chain concept.

To address the lack of data for potential lenders to make informed decision about funding to a

small or medium MFI, it is proposed to use the credit information data made available to CICs

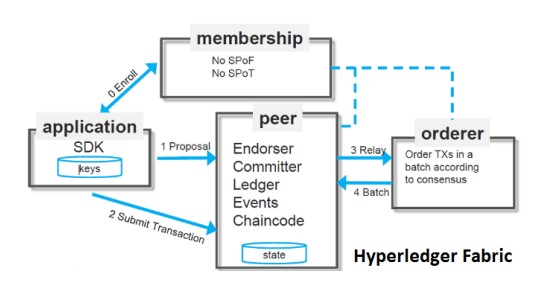

and to leverage the concept of permissioned block chain such as Hyper Ledger fabric. Though

there are other permissioned block chain networks such as R3 Corda etc., are available, the

features of Hyperledger fabric are used to highlight the use case for MFI funding.

Hyperledger fabric is designed for enterprise purpose blockchain network, wherein every

participant has their own replicated copy of the ledger. In addition to ledger information being

shared, the processes which update the ledger are also shared. Unlike today’s systems, where a

participant’s private programs are used to update their private ledgers, a blockchain system

has shared programs to update shared ledgers.

10. https://m.rbi.org.in/scripts/BS_ViewMasDirections.aspx?id=10425

11. https://hyperledger-fabric.readthedocs.io/en/release-2.2/whatis.html

On the one hand, we have listed out some of the enabling regulations for MFIs to share data

with CRCs. We have SROs who have MFIs can onboard with them. We have banks who

need visibility to loan portfolio of MFIs to decide on lending to MFIs so as to meet PSL targets/

expand their business and we have MFIs who welcome fund to run their business.

On the other hand, we have listed out features of permissioned blockchain such as distributed

ledger across nodes, append-only nature, establishing immutability with cryptographic

techniques, smart contract to update information and provide access to information ,

consensus mechanism to ensure that ledgers are updated only after transactions are

approved and also the order in which the transactions are to be updated, security and

membership services, chaincode(smart contract) and asset (Asset definitions enable the

exchange of almost anything with monetary value over the network).

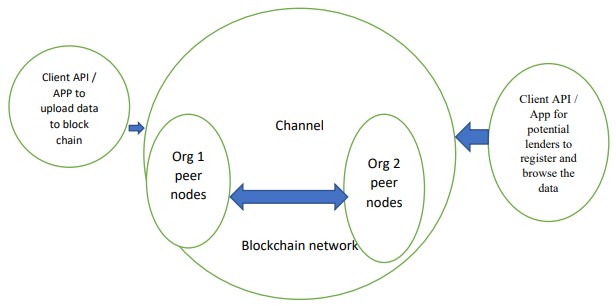

Using the above factors, a solution is proposed in which we consider two organizations,

namely, Sa-DHan and MFIN as consortium members of block chain. They in turn act as an

aggregator for MFIs who are their members.

The SROs maintain peer node wherein the data relating to each MFI is maintained. Each SRO

will have an identity in the block chain. Using client API, the MFIs who are members of these

SROs will upload credit information details of their borrowers on monthly basis as hitherto. (since

data needs to be uploaded to Credit information companies on monthly basis, a copy of the same

can be uploaded to the SRO in which it is a member through the web portal to blockchain). To

address the concerns of privacy and security of the borrowers’ information, customer related

information related field can be blocked out by the MFI before uploading data to SROs. These

fields can be hashed as Hyperledger permits hashing of data so that data can be kept private.

The SRO in turn updates its ledger data of that MFI. Since there is no transaction between the

peer nodes (i.e Sa-DHan and MFIN), endorsement by the updating peer is enough to update the

data in the ledger which gets synchronized with other SRO which has a peer node in the

blockchain. The ledger data will be having name of the MFI, loan outstanding, default or regular

status and filtering can be done to remove any stale data of assets. Smart contract to filter such

details may be built and deployed. If a MFI who is a member of one SRO does not want its data

to be visible in another SRO node, the identity related to MFI can be hashed and the ledger state

can be updated accordingly in the non member SRO node.

A front-end utility (APP) can be provided by the blockchain consortium with a viewing rights to

banks or different types of lenders or venture capitalists who seek access to such information.

The lenders can browse the credit portfolio of a MFI by browsing the credit history of its borrowers

and generate reports by fetching data from block chain. Details of customer such as name, Aadhar

ID, etc would not be revealed as these would be blocked out in the blockchain. This will enable

small and Medium MFIs to show their asset quality and access funds from various categories of

lenders such as Mutual funds, banks, foreign lenders etc., and they will be in a position to price

their lending to MFIs based on the asset quality reflected from the data maintained in the

blockchain. Any additional fields that may be of value can be incorporated in the ledger state. As

per RBI regulations, MFIs can access foreign funds. Having a web interface or APP for the banks

and overseas investors will help the fund providers to browse the asset quality of the MFIs. These

data would not be made available to competitors. This would be on need to know basis with proper

credential access to the various categories of lenders who register for such access in the portal.

This facility can be used to onboard SHGs and other MFIs such as Societies and Trusts who are

not regulated by RBI ,and therefore, do not have to report credit information details to MFI bureau

of CICs and they can upload their data also to SROs with whom they are registered and their

portfolio also can be viewed by the various lenders and NBFCs who lend to MFIs and informed

decision can be taken regarding lending and pricing and this opens up avenues for micro finance

groups that have no access or limited access to formal funding channel to access fund from the

banks and NBFCs.

As regards cost of implementation, currently, a MFI needs to make aggregate data available to

the prospective lenders/investors. Also, prospective lender/investor may expect the data to be

audited before arriving at a decision regarding investment. This involves manpower cost for data

collection and presentation and auditing fee on the part of MFI. However, the Hyperledger fabric

is an open source and it has community edition which can be used free of cost by the SROs.

Though there may be one-time cost of implementation with respect to hardware, cost can be

offset as data would be verified one on block chain which inspires confidence for the prospective

investors/lenders. Further, recurring cost of collation of data and audit can be eliminated.

The MFIs in various categories play a major role in reaching out the unbanked segment of the

society through micro lending. In order to serve the segment well at a cost affordable to them,

raising funds at an affordable cost and with ease is important for them. Using block chain

technology, both lender and borrowing institutions can be brought on board on a single platform

with ease and the data of microfinance institutions can be leveraged to enable objective analysis

of the data and make funding available with ease at an affordable rate to MFIs. This will enable

MFIs to lend at an affordable rate to their borrowers thereby creating a win-win situation for all

stake holders concerned.

i. The author works for Reserve Bank of India and the views expressed in the article are her own and not the views of the Reserve Bank of India.

Blockchain technology promises to revolutionize practically every sector of the modern economy. In this post, we take a look at why everyone’s so excited about blockchain and what do all the wide applications of blockchain really boil down to.

To create a basic level understanding of what blockchain is capable of, let’s look at the 10 things blockchain can do

Blockchains are called so because they are blocks where data is stored in linear containers. These blocks form a chain, so the name blockchain.

Anyone can notice that you’ve placed data there, since it is semi-public and carries your signature. However, only you can unlock what’s there in the block (container). You can do so securely by using the private keys to that data block.

Essentially, blockchain is a database with the “header”, where the information is stored as public. If you think that’s not very good for a database, you’re right. Blockchain isn’t the best database, but that’s not a problem. Blockchain isn’t meant to be the substitute of a database.

Instead, we expect developers to find ways to rewrite their applications that capitalize upon the strong points of blockchain’s state transition capabilities.

Simply put, blockchain has disrupted the database transaction process paradigm.

Firstly, blockchain is a semi-public and therefore distributed ledger. That makes it shareable across multiple entities without sacrificing security.

What’s more, the ledger is time-stamped. This makes every single transaction verifiable and traceable. All computers on the network can validate every single transaction. That becomes one of the key strengths of blockchain – it automatically prevents double-counting. As a result, the chances of both errors as well as fraudulent transactions are virtually zero.

This may appear to be the single most important application of blockchain but there are many more, equally powerful uses of blockchain.

You would’ve noticed by now that being shareable, there’s nothing that is “central” about blockchain. It’s architectured in a way that there’s no central server that dictates transactions – it remains a peer-to-peer network over nodes. Your computer, if a part of the network, can verify transactions happening over the network. You could call it thin computing in its best decentralized format.

Because of this, users can reach out to other users and transact with each other instantly, irrespective of geographical or time-zone differences. There are no intermediaries like a main server to filter or slow down the transaction. Hence, the transaction happens without delay. All nodes on the network have equal importance and can offer their knowledge of all transactions over the network.

This goes beyond just being a peer-to-peer network and creates a marketplace for users, a distributed economy. The size of such marketplaces varies greatly in size without compromising the integrity of blockchain.

Without doubt, cryptocurrencies (aka token) are the most popularly known application of blockchain. Famous examples of cryptocurrency include Bitcoin (BTC), Ethereum (ETH) and Ripple.

Basically, cryptocurrency is an economic proxy of the operations and security of blockchain, a cryptographically encrypted currency. Cryptocurrencies follow a set of protocols and are not dependent on a single government body, entity or authority. They have an open source code, which means anyone can available for everyone to use or modify.

Cryptocurrencies, like other currencies, can have a compensatory as well as production role. Miners who mine out cryptocurrencies and successfully validate blockchain transactions can be awarded the currency. Additionally, there is a consumption role, where you pay a small fee for running smart, blockchain-backed contracts (using Ethereum), an equivalent of transaction fee (with Bitcoin or Ripple). These costs and compensations are placed so as to prevent abuse of the blockchain system. In a larger, more advanced case, tokens may be used simply for internal value, asin DOAs (Distributed Autonomous Organizations).

Technically, it’s a currency and therefore can be traded over currency exchanges, pretty much the same way you trade Euros and Dollars. You can also buy goods and pay for services, with the help of Bitcoins. Such transactions are smooth and secure within the blockchain network.

Of course, when it crosses over and has to interact with traditional, real-world currency, there’s a chance of friction and delay.

Like any other asset, one can invest and transact in cryptocurrencies. As a result, it is susceptible to volatility and hence keeps away a large number of potential investors. The volatility originates from the genuine uncertainty. It is hoped that as it gains more acceptance and more understanding develops, the uncertainty will drop considerably. That would make cryptocurrency more stable in the long run.

Technologies with open source software are not just transparent. They have the benefit of huge improvements by way of collaborations that add massive, valuable features on the top of the core software. That way, users keep tinkering and adding value to the core.

A good case is Bitcoin. Its core protocol is fully open source. From the time Satoshi Nakamoto was inspired by Nick Szabo, it was clear that open source was the way to go. Since its inception, Bitcoin is being maintained by a collaborative group of “core developers”. Their work is continually complemented by contribution from thousands of independent developers the world around. These independent developers constantly come up with complementary products, services and applications that benefit from the Bitcoin protocol and its robust nature. Eventually, we can see an extremely strong ecosystem being built around Bitcoin. Essentially, it’s the open source nature that has led to the level of excellence that Bitcoin is.

Cryptocurrency is ultimately a form of money – it’s just that it happens to be based on a relatively new technology, i.e. blockchain.

Because it’s treated as money, one can easily build investment, loan and insurance web aggregator software platforms where transactions can be done using Cryptocurrencies. Thus Cryptocurrencies can become a part of a financial instrument, which would lead to a variety of financial products, both traditional and new-age. That is the innovative power of blockchain.

Loans, investments, trading with options and derivatives and even synthetic instruments can have their blockchain versions. Exchange Traded Funds (ETFs) are one of the many ways.

Blockchain brings an unprecedented level of trust and openness in everything that uses blockchain. However, at its very basic level, blockchain is software technology, just on a novel frontier.

It excites developers because blockchain offers new tools, new possibilities. With blockchain, they can look forward to building newer applications that both cryptographically secure and fully decentralized. In essence, blockchain can help software and web development usher in a completely new type of application that has never come up earlier.

Besides, blockchain can be used to create newer APIs. This includes transaction scripting language, a peer-to-peer nodes communication API, a client API to validate transactions, data APIs… the list is almost endless.

While blockchain is a software technology, it can also be thought of as a design approach for software, an approach that attaches a large number of computers to one another and requires them to follow a certain ‘code of conduct’ on how to share or accept information. This ‘code of conduct’ will tell them how to validate interactions and transactions verified by cryptography.

It sounds so natural because that’s what blockchain actually is – networked computers with equal value and following a common set of rules. The important part here is that developers will no longer need to set up servers since all computers in the network have equal rights.

For a perspective, you can compare the Web. In the Web, the HTTP protocol request is forwarded to the server and the server approves or disapproves it. That’s because it enjoys server rights. In the case of blockchain, the same request will be sent to the entire blockchain network.

Anyone reading this post would be clear that the blockchain network basically validates transactions. They could be related to digital money or digital assets. When the network reaches a consensus, the transaction is considered valid. It’s then put into a block (a storage space). This block is added at the end of the chain of previous transactions (if any) to indicate this is the latest block. The entire chain of blocks can be verified at any point of time in future to validate any transaction stored in any block.

So blockchain is a giant transaction processing platform, one that verifies and approves legit transactions, no matter what size the transaction is.

A good way to compare various transaction processing networks is the processing capability, measured in transactions per second (TPS). In 2015, VISA clocked an average of 2,000 TPS on VisaNet, the peak capacity being 56,000 TPS. The same year, PayPal recorded about 155 TPS.

Bitcoin, even a year later, wasn’t impressive. Its TPS ranged around a tiny 5 to 7. But that’s not disappointing.

Rapid strides in technology and expected increase in Bitcoin blocks would quickly change this picture. Besides, many blockchains are faster than Bitcoins. Ethereum started with just 10 TPS in 2015, but advanced to 50-100 TPS in 2017 and is targeting 250,000 to 300,000 TPS by 2021.

Besides, private blockchains, for instance, may have fewer restrictions and have operated at 1,000 to 10,000 TPS in 2016. Optimistic figures peg this number at 2,000 to 15,000 TPS in 2017 and almost to unlimited capacity beyond 2021.

Linking blockchain output to clustered database technology is expected to reach such ambitious targets set.

The core benefit of blockchain is trust as the basic unit of service. It’s a function, a delivered service.

However, trust isn’t restricted to transactions only. Trust is built in data, services, processes, agreements, objects, business processes and logic and so on. In fact, anything that can be boiled down to digitization and carries an inherent value can benefit from blockchain. Banks are already exploring cross-border transactions where blockchain can add huge value.